Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jike has been advised by his bank manager that he ought to provide a forecast of his cash position at the end of each moath.

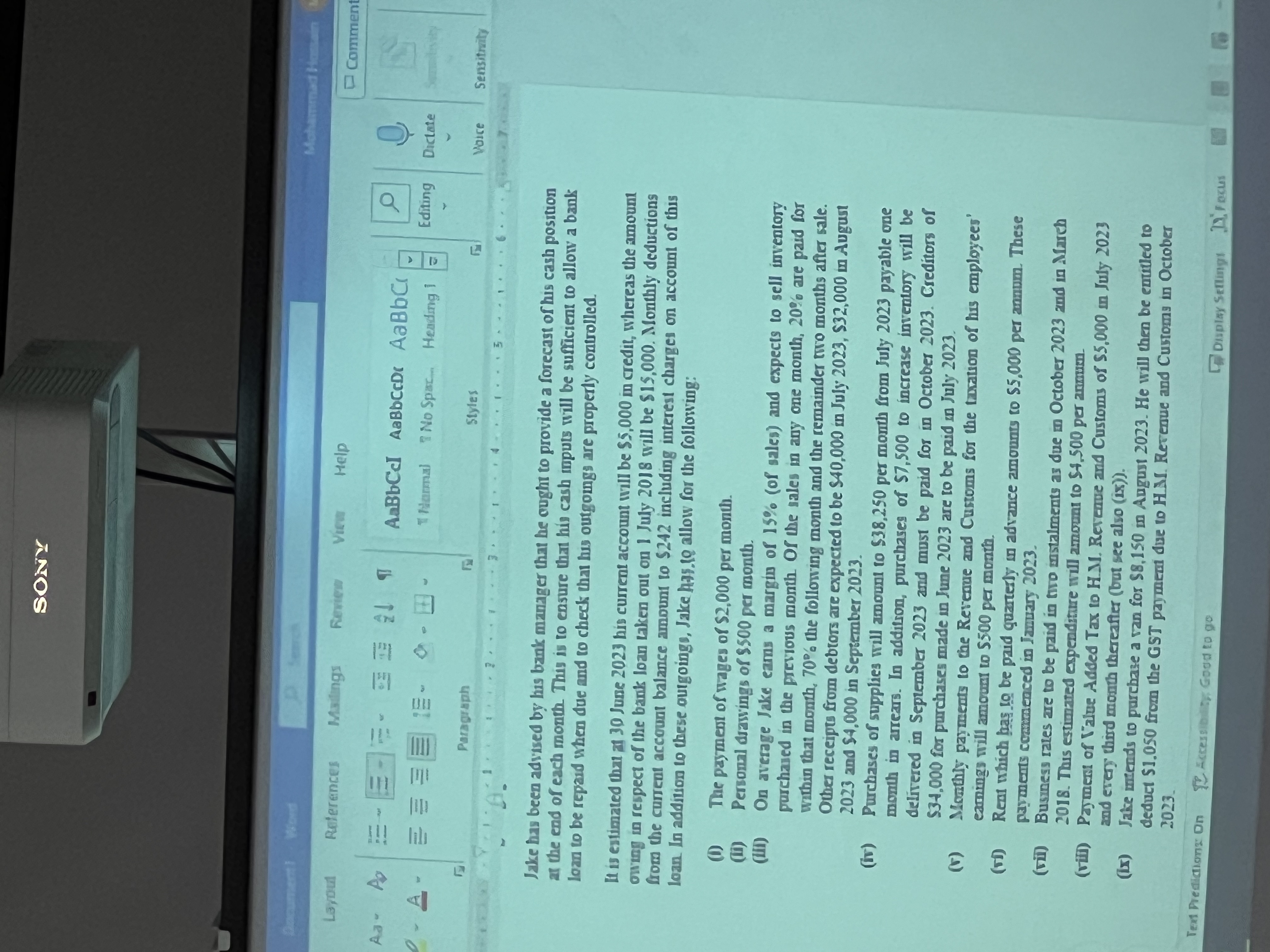

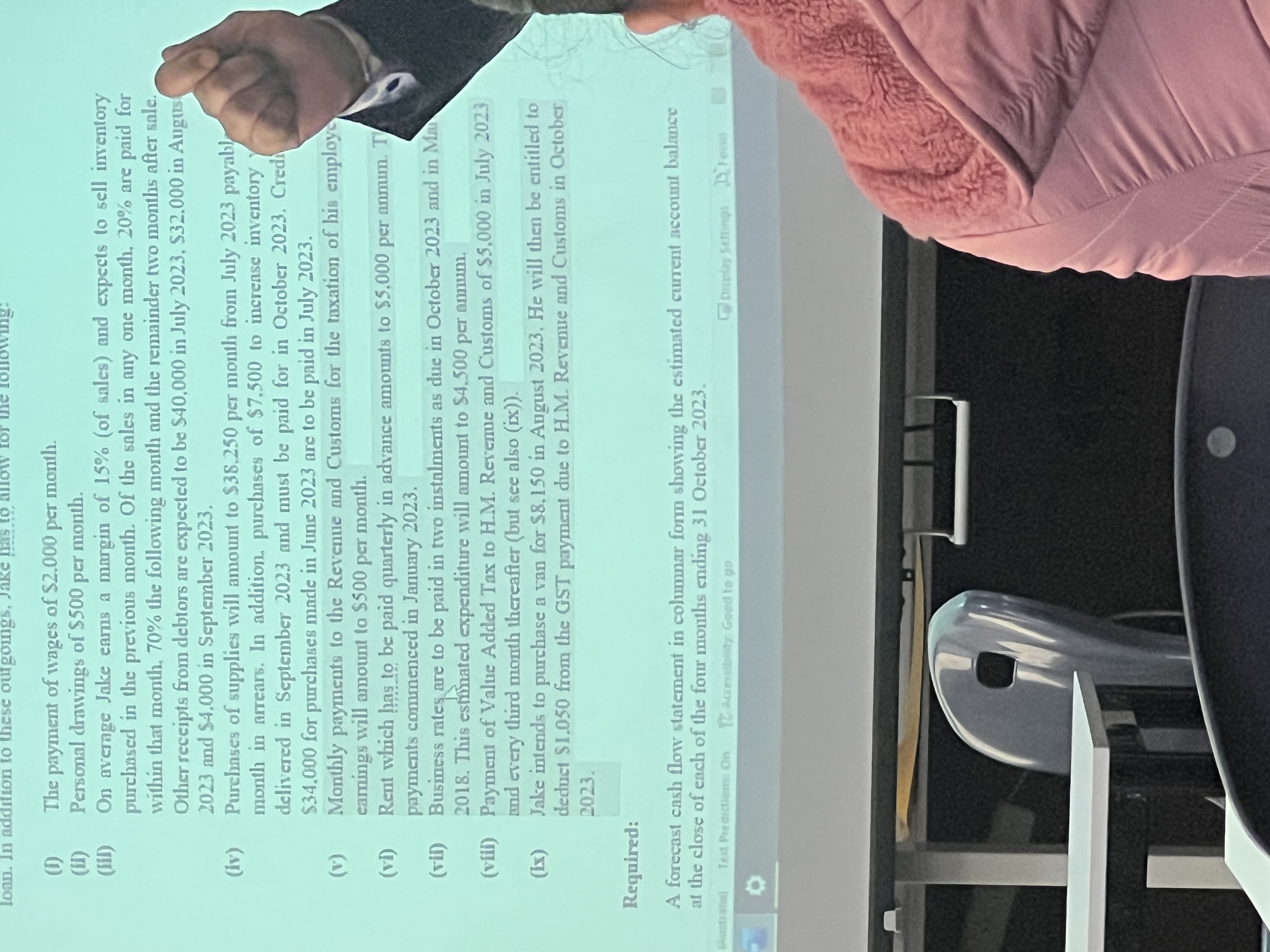

Jike has been advised by his bank manager that he ought to provide a forecast of his cash position at the end of each moath. This is to casure that his cash inputs will be sufficient to allow a bank loan to be repard when due and to check that his outgoungs are properly controlled. If is estimated that at 30 June 2023 his current account will be 55,000 in credit, whereas the amoum owing in respect of the bank loan taken out on I July 2018 will be 515,000 . Monthly deductions from the current account balance amount to $242 including interest charges on account of this loan In addition to these outgoing, Jake has.1Q allow for the following: (i) The pasment of wages of $2,000 per monih. (ii) Persomal drasings or $500 per monith. (IIi) On average Jake eams a margin of 15% (of sales) and expects to sell inventory purchaied in the previous month. Or the iales in any one month, 20\% are paid for Within that momth, 70 the following month and the remainder tro months after sale. Other receipts from debrors are expecied lo be \$40,000 in July 2023, \$32,000 in Augurt 2023 and 54.000 in Septermber 2023. (iv) Purchases of supplies will amount to $38,250 per month from fuly 2023 payable ore month in arreas. In addifron, purchases of 57,500 to increase invemiony will be delivered in Seplember 2023 and must be paid for in October 2023. Creditors of \$34.000 for purchases made in June 2023 are to be paid un July 2023. (v) Momthly payments to che Revenue and Curtoms for the toration of his employees' eamings will amouns to $500 per month. (vi) Real which has to be paid guartesly in adrace amounts co 55,000 per ammun. These payments commenced in Imuary 2023. (vii) Businesy rates are to be paid in tro anstalments as due in October 2023 and in Mareh 2018. This extimated espendature ivill amoun to 54,500 per anowin. (viii) Pajmers of Value Added Tax to H.M. Revenue and Customs of $5,000 in July 2023 and erey third mointh thereafter (but see also (is)). (ix) Jake mends to parchase a van for $8,150 in Augur 2023. He will then be emutled to deduet 51.050 from the CST paymeral due to H.M. Rerenue and Customs in October 2023. (I) The payment of wages of $2.000 per monilh. (ii) Personal drawings of $500 per month. (Iii) On avernge Jake earns a margin of 15% (of sales) and expects to sell inventory purchased in the previous month. Of the sales in any one month, 20% are paid for within that month, 70% the following month and the remainder two months after sale. Other receipts from debtors are expected to be $40,000 in July 2023, $32.000 in Augus. 2023 and \$4.000 in September 2023. (iv) Purchnses of supplies will amount to \$38.250 per monilh from July 2023 payabl month in arrears. In addition, purehases of $7.500 to inerense inventory delivesed in September 2023 and must be paid for in October 2023. Creds $34,000 for purchases marle in June 2023 are to be paid in July 2023. (v) Monthly payments to the Revenue and Customs for the taxation of his employs eamings will anount to $500 per month. (vi) Rent which las to be paid quarterly in advance amounts to $5,000 per anmum. payments commenced in January 2023. (vii) Business rates are to be paid in two instalnemts as due in October 2023 and in Mar 2018. This esmated expenditure will amount to $4.500 per amum. (viii) Payment of Value Added Tax to H.M. Rerenue and Customs of $5,000 in July 2023 and erery third month thereafter (but see also (ix)). (Ix) Jake intends to purchase a van for $8.150 in Angust 2023. He will then be entitled to deduet \$1.050 from the GST payment due to H.M. Revenue and Customs in Oetober 2023. Required: A forecast cash flow statement in columnar form showing the estimated current account balmse at the close of each of the form momths ending 31 Oetober 2023

Jike has been advised by his bank manager that he ought to provide a forecast of his cash position at the end of each moath. This is to casure that his cash inputs will be sufficient to allow a bank loan to be repard when due and to check that his outgoungs are properly controlled. If is estimated that at 30 June 2023 his current account will be 55,000 in credit, whereas the amoum owing in respect of the bank loan taken out on I July 2018 will be 515,000 . Monthly deductions from the current account balance amount to $242 including interest charges on account of this loan In addition to these outgoing, Jake has.1Q allow for the following: (i) The pasment of wages of $2,000 per monih. (ii) Persomal drasings or $500 per monith. (IIi) On average Jake eams a margin of 15% (of sales) and expects to sell inventory purchaied in the previous month. Or the iales in any one month, 20\% are paid for Within that momth, 70 the following month and the remainder tro months after sale. Other receipts from debrors are expecied lo be \$40,000 in July 2023, \$32,000 in Augurt 2023 and 54.000 in Septermber 2023. (iv) Purchases of supplies will amount to $38,250 per month from fuly 2023 payable ore month in arreas. In addifron, purchases of 57,500 to increase invemiony will be delivered in Seplember 2023 and must be paid for in October 2023. Creditors of \$34.000 for purchases made in June 2023 are to be paid un July 2023. (v) Momthly payments to che Revenue and Curtoms for the toration of his employees' eamings will amouns to $500 per month. (vi) Real which has to be paid guartesly in adrace amounts co 55,000 per ammun. These payments commenced in Imuary 2023. (vii) Businesy rates are to be paid in tro anstalments as due in October 2023 and in Mareh 2018. This extimated espendature ivill amoun to 54,500 per anowin. (viii) Pajmers of Value Added Tax to H.M. Revenue and Customs of $5,000 in July 2023 and erey third mointh thereafter (but see also (is)). (ix) Jake mends to parchase a van for $8,150 in Augur 2023. He will then be emutled to deduet 51.050 from the CST paymeral due to H.M. Rerenue and Customs in October 2023. (I) The payment of wages of $2.000 per monilh. (ii) Personal drawings of $500 per month. (Iii) On avernge Jake earns a margin of 15% (of sales) and expects to sell inventory purchased in the previous month. Of the sales in any one month, 20% are paid for within that month, 70% the following month and the remainder two months after sale. Other receipts from debtors are expected to be $40,000 in July 2023, $32.000 in Augus. 2023 and \$4.000 in September 2023. (iv) Purchnses of supplies will amount to \$38.250 per monilh from July 2023 payabl month in arrears. In addition, purehases of $7.500 to inerense inventory delivesed in September 2023 and must be paid for in October 2023. Creds $34,000 for purchases marle in June 2023 are to be paid in July 2023. (v) Monthly payments to the Revenue and Customs for the taxation of his employs eamings will anount to $500 per month. (vi) Rent which las to be paid quarterly in advance amounts to $5,000 per anmum. payments commenced in January 2023. (vii) Business rates are to be paid in two instalnemts as due in October 2023 and in Mar 2018. This esmated expenditure will amount to $4.500 per amum. (viii) Payment of Value Added Tax to H.M. Rerenue and Customs of $5,000 in July 2023 and erery third month thereafter (but see also (ix)). (Ix) Jake intends to purchase a van for $8.150 in Angust 2023. He will then be entitled to deduet \$1.050 from the GST payment due to H.M. Revenue and Customs in Oetober 2023. Required: A forecast cash flow statement in columnar form showing the estimated current account balmse at the close of each of the form momths ending 31 Oetober 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started