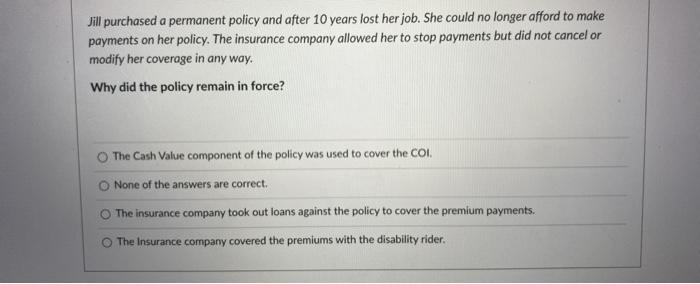

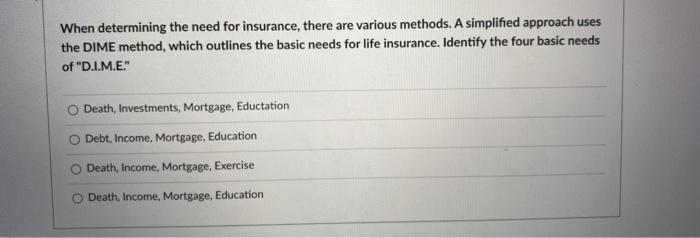

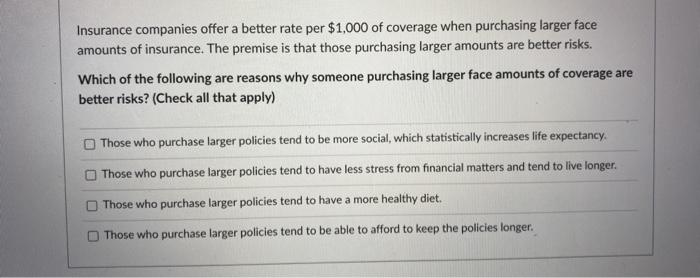

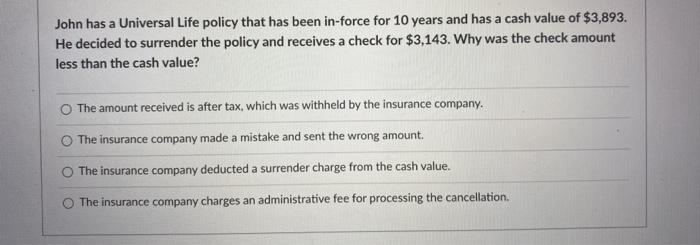

Jill purchased a permanent policy and after 10 years lost her job. She could no longer afford to make payments on her policy. The insurance company allowed her to stop payments but did not cancel or modify her coverage in any way. Why did the policy remain in force? The Cash Value component of the policy was used to cover the COI None of the answers are correct The insurance company took out loans against the policy to cover the premium payments. The Insurance company covered the premiums with the disability rider. When determining the need for insurance, there are various methods. A simplified approach uses the DIME method, which outlines the basic needs for life insurance. Identify the four basic needs of "D.I.M.E." Death, Investments, Mortgage, Eductation Debt, Income, Mortgage, Education Death, Income, Mortgage, Exercise O Death, Income, Mortgage, Education Insurance companies offer a better rate per $1,000 of coverage when purchasing larger face amounts of insurance. The premise is that those purchasing larger amounts are better risks. Which of the following are reasons why someone purchasing larger face amounts of coverage are better risks? (Check all that apply) Those who purchase larger policies tend to be more social, which statistically increases life expectancy. Those who purchase larger policies tend to have less stress from financial matters and tend to live longer. Those who purchase larger policies tend to have a more healthy diet. Those who purchase larger policies tend to be able to afford to keep the policies longer. John has a Universal Life policy that has been in-force for 10 years and has a cash value of $3,893. He decided to surrender the policy and receives a check for $3,143. Why was the check amount less than the cash value? The amount received is after tax, which was withheld by the insurance company. The insurance company made a mistake and sent the wrong amount The insurance company deducted a surrender charge from the cash value. The insurance company charges an administrative fee for processing the cancellation. Jack fell down the stairs, broke his neck and died. He had a $250,000 Universal Life insurance policy that also had a rider that paid his spouse an additional $250,000 for certain types of death. Which benefit rider did jack have? Catastrophic Rider Mortuary Indemnity Rider Accidental Death Rider Guaranteed Insurability Rider