Question

Jim: Jim is a retired doctor. He was married for 25 years until his wife died about two years ago. He now lives alone. Financially,

Jim:

-

Jim is a retired doctor. He was married for 25 years until his wife died about two years ago. He now lives alone. Financially, Jim is comfortable in retirement largely as a result of following a financial plan as a married couple for many years.

-

Jim is active, in good health and helps out as a volunteer in several community activities.

-

Jim is interested in scuba diving and likes to visit famous reefs and shipwrecks. Many of these sites are overseas. Ideally, he would like to undertake an overseas holiday each year.

-

Jim is conservative by nature even more so since retiring and losing his wife. He has no interest in risky investments

Question:

1a) Assess the objective of repaying the car loan within 3 years (assume the interest rate is 8%)

b)

Discuss the scope to establish a savings plan to enable Jim to take leave of absence from his job to work overseas as a volunteer in a refugee camp for a period of one year (assume the required savings goal is AUD38,000 and an interest rate on savings of 5%

c)

Jim holds a well paid job that offers good career progression. HE is relatively young and has many years remaining in the workforce until retirement. HIS salary should steadily increase with time and the amount of surplus money should also increase.

Outline the types of investments she should consider for the allocation of surplus money.

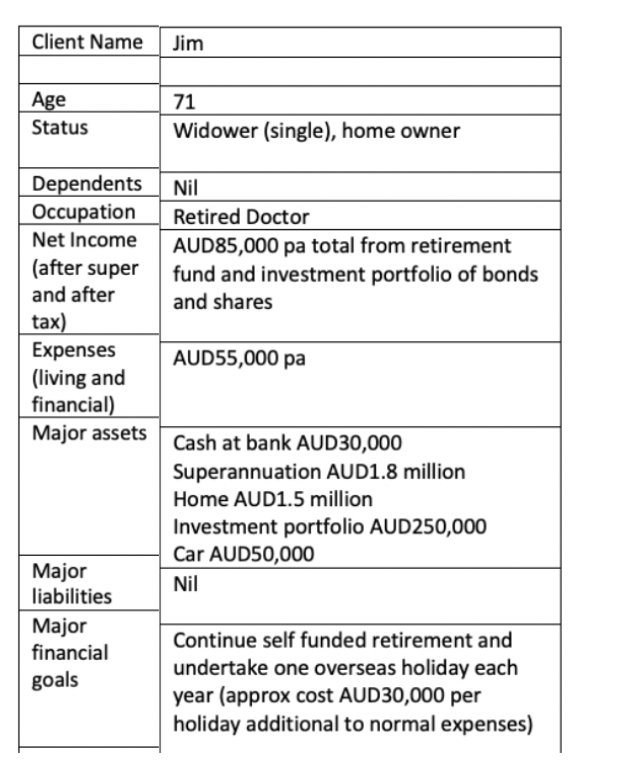

Client Name Jim Age Status 71 Widower (single), home owner Dependents Nil Occupation Retired Doctor Net Income AUD85,000 pa total from retirement (after super fund and investment portfolio of bonds and after and shares tax) Expenses AUD55,000 pa (living and financial) Major assets Cash at bank AUD30,000 Superannuation AUD1.8 million Home AUD1.5 million Investment portfolio AUD250,000 Car AUD50,000 Major Nil liabilities Major Continue self funded retirement and financial undertake one overseas holiday each goals year (approx cost AUD30,000 per holiday additional to normal expenses) Client Name Jim Age Status 71 Widower (single), home owner Dependents Nil Occupation Retired Doctor Net Income AUD85,000 pa total from retirement (after super fund and investment portfolio of bonds and after and shares tax) Expenses AUD55,000 pa (living and financial) Major assets Cash at bank AUD30,000 Superannuation AUD1.8 million Home AUD1.5 million Investment portfolio AUD250,000 Car AUD50,000 Major Nil liabilities Major Continue self funded retirement and financial undertake one overseas holiday each goals year (approx cost AUD30,000 per holiday additional to normal expenses)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started