Answered step by step

Verified Expert Solution

Question

1 Approved Answer

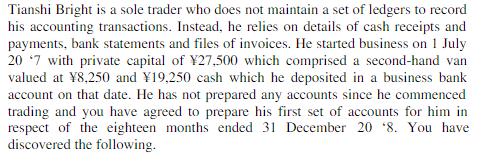

Tianshi Bright is a sole trader who does not maintain a set of ledgers to record his accounting transactions. Instead, he relies on details

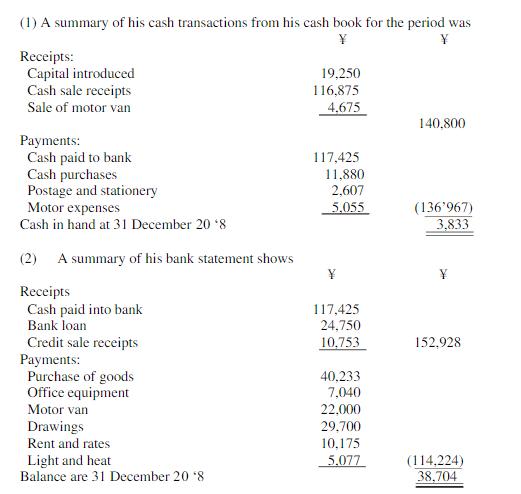

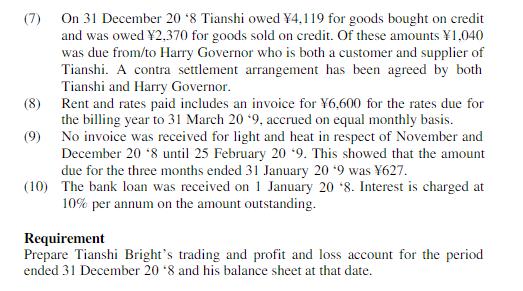

Tianshi Bright is a sole trader who does not maintain a set of ledgers to record his accounting transactions. Instead, he relies on details of cash receipts and payments, bank statements and files of invoices. He started business on 1 July 20 7 with private capital of 27,500 which comprised a second-hand van valued at Y8.250 and 19,250 cash which he deposited in a business bank account on that date. He has not prepared any accounts since he commenced trading and you have agreed to prepare his first set of accounts for him in respect of the eighteen months ended 31 December 20 8. You have discovered the following. (1) A summary of his cash transactions from his cash book for the period was Y Y Receipts: Capital introduced Cash sale receipts Sale of motor van Payments: Cash paid to bank Cash purchases Postage and stationery Motor expenses Cash in hand at 31 December 2018 (2) A summary of his bank statement shows Receipts Cash paid into bank Bank loan Credit sale receipts Payments: Purchase of goods Office equipment Motor van Drawings Rent and rates Light and heat Balance are 31 December 208 19,250 116,875 4.675 117,425 11,880 2,607 5.055 Y 117,425 24,750 10,753 40.233 7,040 22,000 29,700 10,175 5.077 140,800 (136'967) 3,833 152,928 (114,224) 38,704 (7) On 31 December 20 '8 Tianshi owed 4,119 for goods bought on credit and was owed Y2.370 for goods sold on credit. Of these amounts 1,040 was due from/to Harry Governor who is both a customer and supplier of Tianshi. A contra settlement arrangement has been agreed by both Tianshi and Harry Governor. (8) (9) Rent and rates paid includes an invoice for Y6,600 for the rates due for the billing year to 31 March 20 9, accrued on equal monthly basis. No invoice was received for light and heat in respect of November and December 20 *8 until 25 February 20 *9. This showed that the amount due for the three months ended 31 January 20 9 was Y627. (10) The bank loan was received on 1 January 20 8. Interest is charged at 10% per annum on the amount outstanding. Requirement Prepare Tianshi Bright's trading and profit and loss account for the period ended 31 December 20 '8 and his balance sheet at that date.

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Trading and Profit or Loss From 1st July 20x7 to 31st Dec 20x8 Particulars Working Amount Particular...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started