Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AMR paints Itd.(APL) is a large paint company in India with 32% market share. The demand for decorative paints is expected to increase due

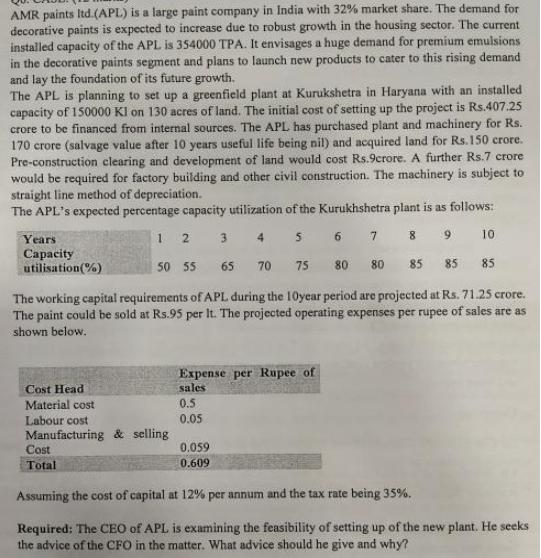

AMR paints Itd.(APL) is a large paint company in India with 32% market share. The demand for decorative paints is expected to increase due to robust growth in the housing sector. The current installed capacity of the APL is 354000 TPA. It envisages a huge demand for premium emulsions in the decorative paints segment and plans to launch new products to cater to this rising demand and lay the foundation of its future growth. The APL is planning to set up a greenfield plant at Kurukshetra in Haryana with an installed capacity of 150000 KI on 130 acres of land. The initial cost of setting up the project is Rs.407.25 crore to be financed from internal sources. The APL has purchased plant and machinery for Rs. 170 crore (salvage value after 10 years useful life being nil) and acquired land for Rs. 150 crore. Pre-construction clearing and development of land would cost Rs.9crore. A further Rs.7 crore would be required for factory building and other civil construction. The machinery is subject to straight line method of depreciation. The APL's expected percentage capacity utilization of the Kurukhshetra plant is as follows: 4 5 8 9 10 65 70 75 80 80 85 85 85 The working capital requirements of APL during the 10year period are projected at Rs. 71.25 crore. The paint could be sold at Rs.95 per It. The projected operating expenses per rupee of sales are as shown below. Years Capacity utilisation (%) 12 Cost Total 50 55 Cost Head Material cost Labour cost Manufacturing & selling 3 Expense per Rupee of sales 0.5 0.05 0.059 0.609 6 7 Assuming the cost of capital at 12% per annum and the tax rate being 35%. Required: The CEO of APL is examining the feasibility of setting up of the new plant. He seeks the advice of the CFO in the matter. What advice should he give and why?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The CFO should advise the CEO of APL to proceed with the plans to set up the new plant at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started