Answered step by step

Verified Expert Solution

Question

1 Approved Answer

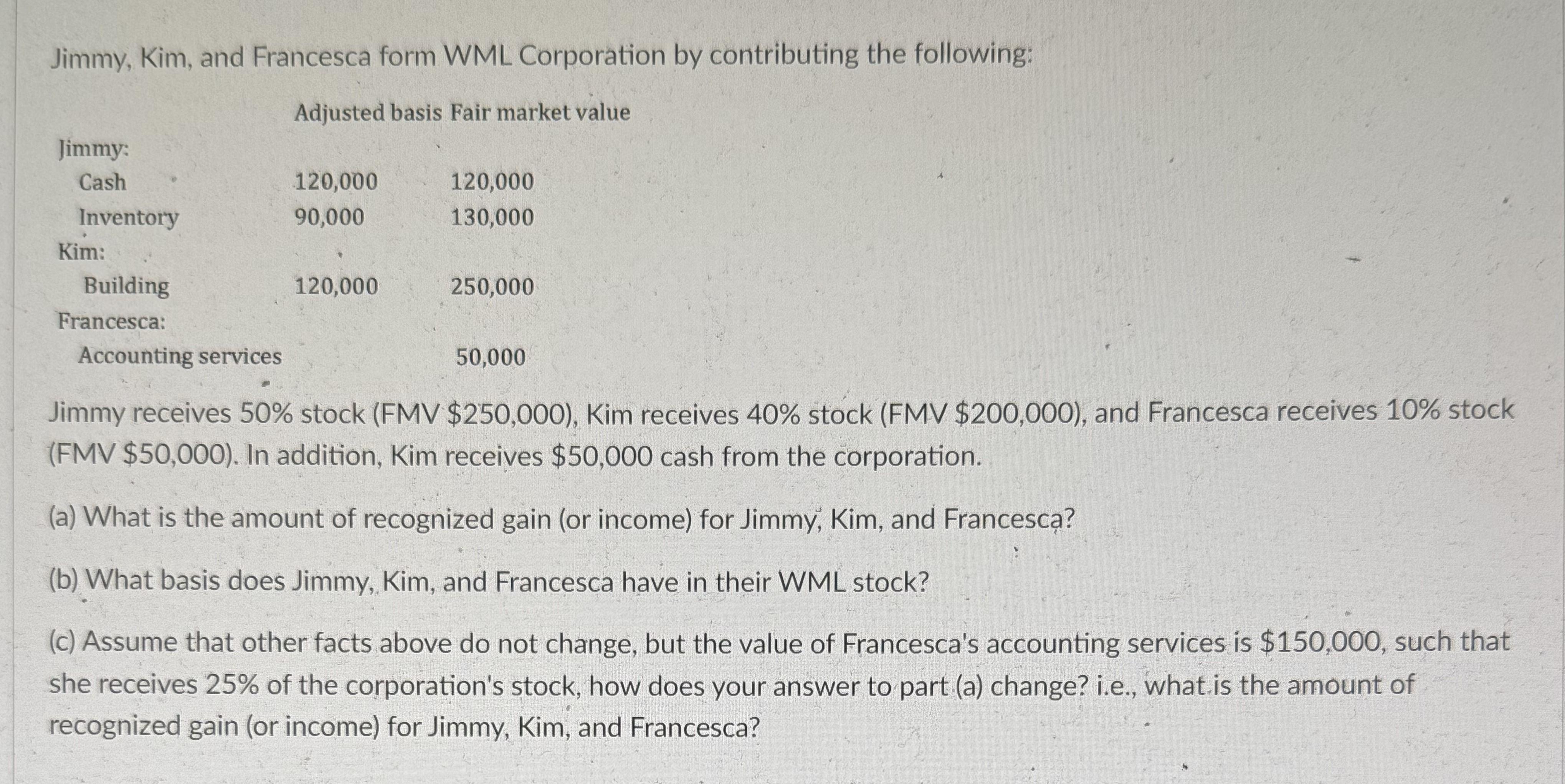

Jimmy, Kim, and Francesca form WML Corporation by contributing the following: Adjusted basis Fair market value Jimmy: Cash 120,000 120,000 Inventory 90,000 130,000 Kim:

Jimmy, Kim, and Francesca form WML Corporation by contributing the following: Adjusted basis Fair market value Jimmy: Cash 120,000 120,000 Inventory 90,000 130,000 Kim: Building 120,000 250,000 50,000 Francesca: Accounting services Jimmy receives 50% stock (FMV $250,000), Kim receives 40% stock (FMV $200,000), and Francesca receives 10% stock (FMV $50,000). In addition, Kim receives $50,000 cash from the corporation. (a) What is the amount of recognized gain (or income) for Jimmy, Kim, and Francesca? (b) What basis does Jimmy, Kim, and Francesca have in their WML stock? (c) Assume that other facts above do not change, but the value of Francesca's accounting services is $150,000, such that she receives 25% of the corporation's stock, how does your answer to part (a) change? i.e., what is the amount of recognized gain (or income) for Jimmy, Kim, and Francesca?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To determine the recognized gain or income for each individual we need to compare their fair market value FMV of contributions with their adj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663df51eadd8d_960775.pdf

180 KBs PDF File

663df51eadd8d_960775.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started