Answered step by step

Verified Expert Solution

Question

1 Approved Answer

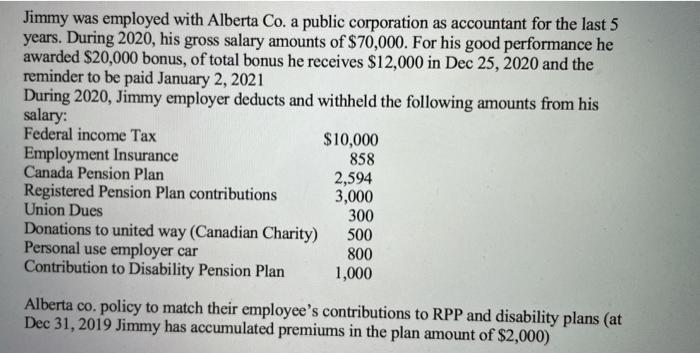

Jimmy was employed with Alberta Co. a public corporation as accountant for the last 5 years. During 2020, his gross salary amounts of $70,000.

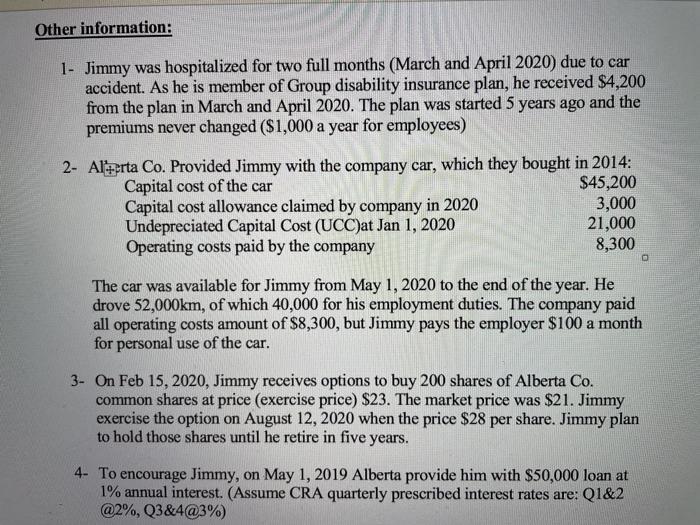

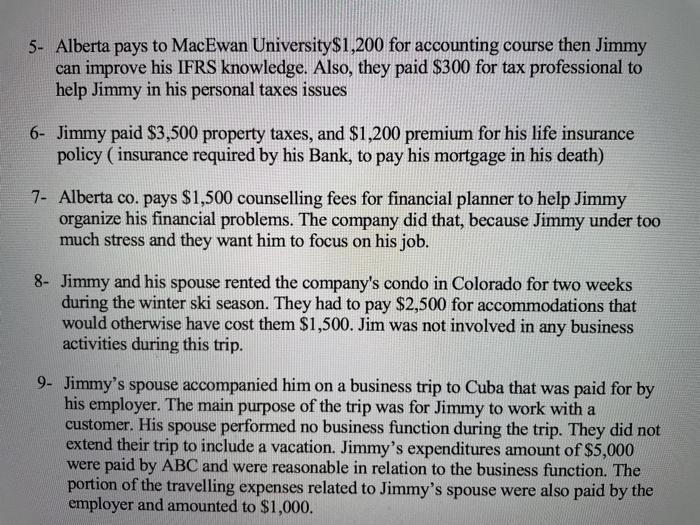

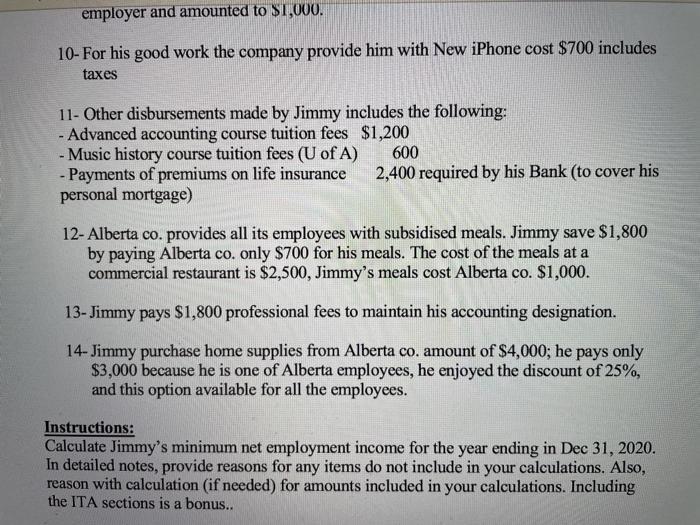

Jimmy was employed with Alberta Co. a public corporation as accountant for the last 5 years. During 2020, his gross salary amounts of $70,000. For his good performance he awarded $20,000 bonus, of total bonus he receives $12,000 in Dec 25, 2020 and the reminder to be paid January 2, 2021 During 2020, Jimmy employer deducts and withheld the following amounts from his salary: Federal income Tax Employment Insurance Canada Pension Plan Registered Pension Plan contributions Union Dues Donations to united way (Canadian Charity) Personal use employer car Contribution to Disability Pension Plan $10,000 858 2,594 3,000 300 500 800 1,000 Alberta co. policy to match their employee's contributions to RPP and disability plans (at Dec 31, 2019 Jimmy has accumulated premiums in the plan amount of $2,000) Other information: 1- Jimmy was hospitalized for two full months (March and April 2020) due to car accident. As he is member of Group disability insurance plan, he received $4,200 from the plan in March and April 2020. The plan was started 5 years ago and the premiums never changed ($1,000 a year for employees) 2- Alerta Co. Provided Jimmy with the company car, which they bought in 2014: Capital cost of the car $45,200 Capital cost allowance claimed by company in 2020 Undepreciated Capital Cost (UCC)at Jan 1, 2020 Operating costs paid by the company 3,000 21,000 8,300 The car was available for Jimmy from May 1, 2020 to the end of the year. He drove 52,000km, of which 40,000 for his employment duties. The company paid all operating costs amount of $8,300, but Jimmy pays the employer $100 a month for personal use of the car. 3- On Feb 15, 2020, Jimmy receives options to buy 200 shares of Alberta Co. common shares at price (exercise price) $23. The market price was $21. Jimmy exercise the option on August 12, 2020 when the price $28 per share. Jimmy plan to hold those shares until he retire in five years. 4- To encourage Jimmy, on May 1, 2019 Alberta provide him with $50,000 loan at 1% annual interest. (Assume CRA quarterly prescribed interest rates are: Q1&2 @2%, Q3&4@3%) 5- Alberta pays to MacEwan University$1,200 for accounting course then Jimmy can improve his IFRS knowledge. Also, they paid $300 for tax professional to help Jimmy in his personal taxes issues 6- Jimmy paid $3,500 property taxes, and $1,200 premium for his life insurance policy (insurance required by his Bank, to pay his mortgage in his death) 7- Alberta co. pays $1,500 counselling fees for financial planner to help Jimmy organize his financial problems. The company did that, because Jimmy under too much stress and they want him to focus on his job. 8- Jimmy and his spouse rented the company's condo in Colorado for two weeks during the winter ski season. They had to pay $2,500 for accommodations that would otherwise have cost them $1,500. Jim was not involved in any business activities during this trip. 9- Jimmy's spouse accompanied him on a business trip to Cuba that was paid for by his employer. The main purpose of the trip was for Jimmy to work with a customer. His spouse performed no business function during the trip. They did not extend their trip to include a vacation. Jimmy's expenditures amount of $5,000 were paid by ABC and were reasonable in relation to the business function. The portion of the travelling expenses related to Jimmy's spouse were also paid by the employer and amounted to $1,000. employer and amounted to $1,000. 10- For his good work the company provide him with New iPhone cost $700 includes taxes 11- Other disbursements made by Jimmy includes the following: - Advanced accounting course tuition fees $1,200 - Music history course tuition fees (U of A) Payments of premiums on life insurance personal mortgage) - 600 2,400 required by his Bank (to cover his 12- Alberta co. provides all its employees with subsidised meals. Jimmy save $1,800 by paying Alberta co. only $700 for his meals. The cost of the meals at a commercial restaurant is $2,500, Jimmy's meals cost Alberta co. $1,000. 13- Jimmy pays $1,800 professional fees to maintain his accounting designation. 14- Jimmy purchase home supplies from Alberta co. amount of $4,000; he pays only $3,000 because he is one of Alberta employees, he enjoyed the discount of 25%, and this option available for all the employees. Instructions: Calculate Jimmy's minimum net employment income for the year ending in Dec 31, 2020. In detailed notes, provide reasons for any items do not include in your calculations. Also, reason with calculation (if needed) for amounts included in your calculations. Including the ITA sections is a bonus..

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Jimmys minimum net employment income for the year ending in Dec 31 2020 is 52000 Reasons for items not included in the calculation 1 Jimmys hospitaliz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63611b6f6f374_214418.pdf

180 KBs PDF File

63611b6f6f374_214418.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started