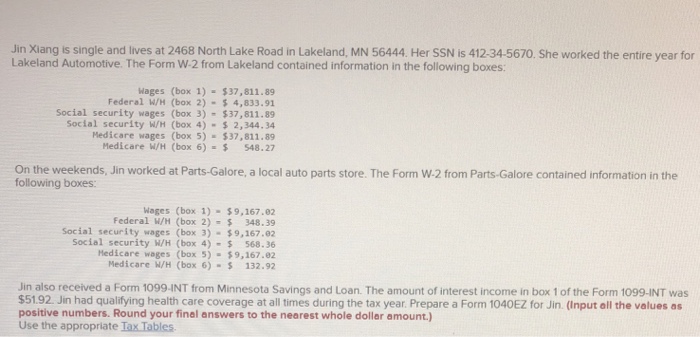

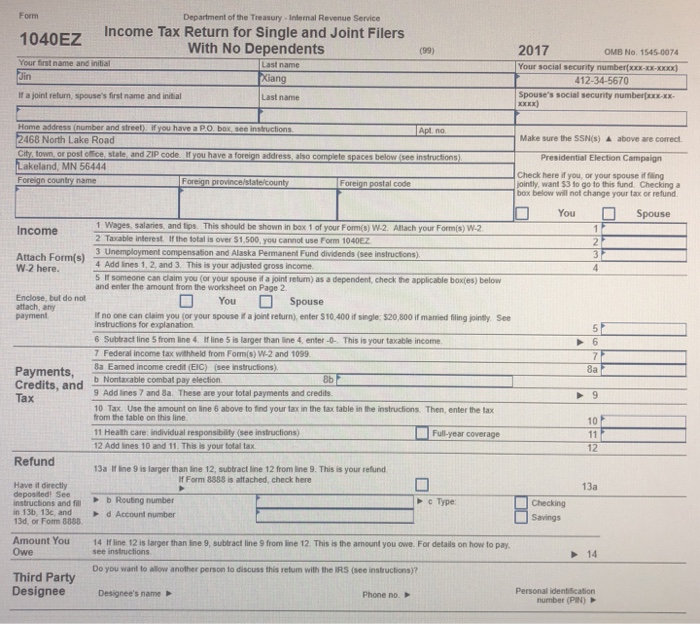

Jin Xiang is single and lives at 2468 North Lake Road in Lakeland, MN 56444. Her SSN is 412-34-5670. She worked the entire year for Lakeland Automotive. The Form W-2 from Lakeland contained information in the following boxes Wages (box 1)$37,811.89 Federal W/H (box 2)- 4,833.91 Social security wages (box 3) $37,811.89 Social security W/H (box 4) $ 2,344.34 Medicare wages (box 5)$37,811.89 Medicare W/H (box 6)548.27 On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes: Wages (box 1) $9,167.82 Federal W/H (box 2) $ 348.39 Social security wages (box 3)- $9,167.82 Social security W/H (box 4)-$ 568.36 Hedicare wages (box 5)9,167.82 Medicare W/H (box 6)- 132.92 Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92. Jin had qualifying health care coverage at all times during the tax year. Prepare a Form 1040EZ for Jin. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.) Use the appropriate Tax Tables Jin Xiang is single and lives at 2468 North Lake Road in Lakeland, MN 56444. Her SSN is 412-34-5670. She worked the entire year for Lakeland Automotive. The Form W-2 from Lakeland contained information in the following boxes Wages (box 1)$37,811.89 Federal W/H (box 2)- 4,833.91 Social security wages (box 3) $37,811.89 Social security W/H (box 4) $ 2,344.34 Medicare wages (box 5)$37,811.89 Medicare W/H (box 6)548.27 On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes: Wages (box 1) $9,167.82 Federal W/H (box 2) $ 348.39 Social security wages (box 3)- $9,167.82 Social security W/H (box 4)-$ 568.36 Hedicare wages (box 5)9,167.82 Medicare W/H (box 6)- 132.92 Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92. Jin had qualifying health care coverage at all times during the tax year. Prepare a Form 1040EZ for Jin. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.) Use the appropriate Tax Tables