Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jinhee Ju, 27, has an annual salary of $37,000. Jinhee wants to buy a new car in 3 years, and she wants to save

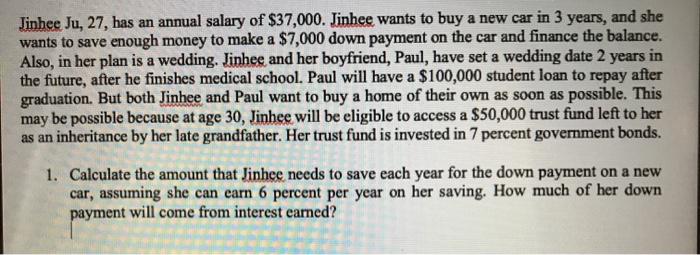

Jinhee Ju, 27, has an annual salary of $37,000. Jinhee wants to buy a new car in 3 years, and she wants to save enough money to make a $7,000 down payment on the car and finance the balance. Also, in her plan is a wedding. Jinhee and her boyfriend, Paul, have set a wedding date 2 years in the future, after he finishes medical school. Paul will have a $100,000 student loan to repay after graduation. But both Jinhee and Paul want to buy a home of their own as soon as possible. This may be possible because at age 30, Jinhee will be eligible to access a $50,000 trust fund left to her as an inheritance by her late grandfather. Her trust fund is invested in 7 percent government bonds. 1. Calculate the amount that Jinhee needs to save each year for the down payment on a new car, assuming she can carn 6 percent per year on her saving. How much of her down payment will come from interest earned?

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 To make the down payment she needs to have 7000 in 3 years The yearly a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started