Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JJ produces and sells cotton jerseys. The company uses variable costing for internal purposes and absorption costing for external reporting. At year-end, financial information

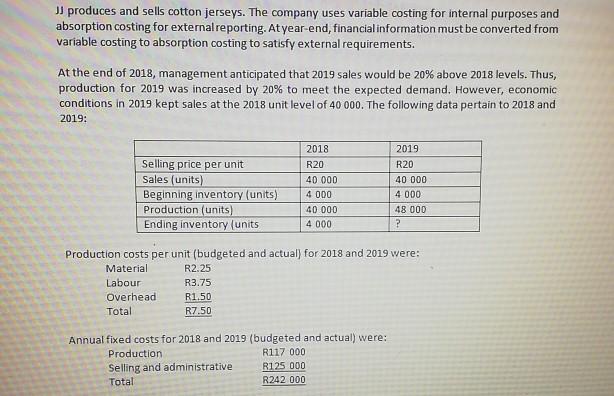

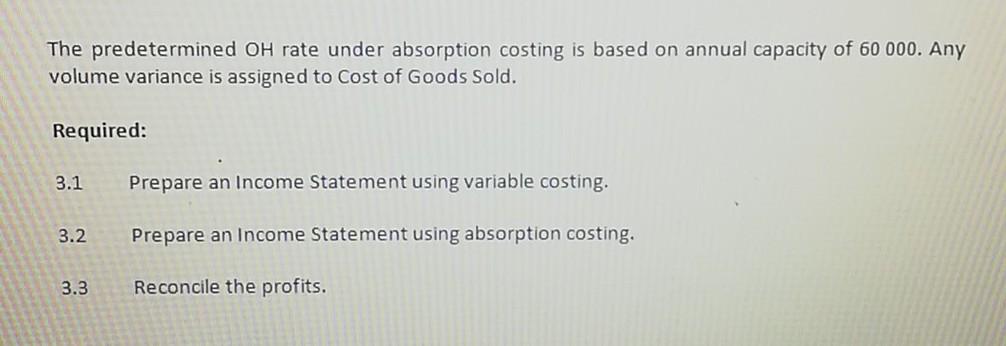

JJ produces and sells cotton jerseys. The company uses variable costing for internal purposes and absorption costing for external reporting. At year-end, financial information must be converted from variable costing to absorption costing to satisfy external requirements. At the end of 2018, management anticipated that 2019 sales would be 20% above 2018 levels. Thus, production for 2019 was increased by 20% to meet the expected demand. However, economic conditions in 2019 kept sales at the 2018 unit level of 40 000. The following data pertain to 2018 and 2019: Selling price per unit Sales (units) Beginning inventory (units) Production (units) Ending inventory (units 2018 R20 R2.25 R3.75 R1.50 R7.50 40 000 4 000 40 000 4 000 Production costs per unit (budgeted and actual) for 2018 and 2019 were: Material Labour Overhead Total Annual fixed costs for 2018 and 2019 (budgeted and actual) were: Production R117 000 Selling and administrative Total 2019 R20 40 000 4 000 48 000 ? R125 000 R242 000 The predetermined OH rate under absorption costing is based on annual capacity of 60 000. Any volume variance is assigned to Cost of Goods Sold. Required: 3.1 3.2 3.3 Prepare an Income Statement using variable costing. Prepare an Income Statement using absorption costing. Reconcile the profits.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

File 1 2 3 4 5 6 7 8 9 10 44 12 13 14 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Ready File ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started