Question

JJA SA launched an offer on Pacemaker Ltd on 1/1/22, offering Pacemakers shareholders a 60%/40% (share/cash) mixed offer with a 35% premium over Pacemaker current

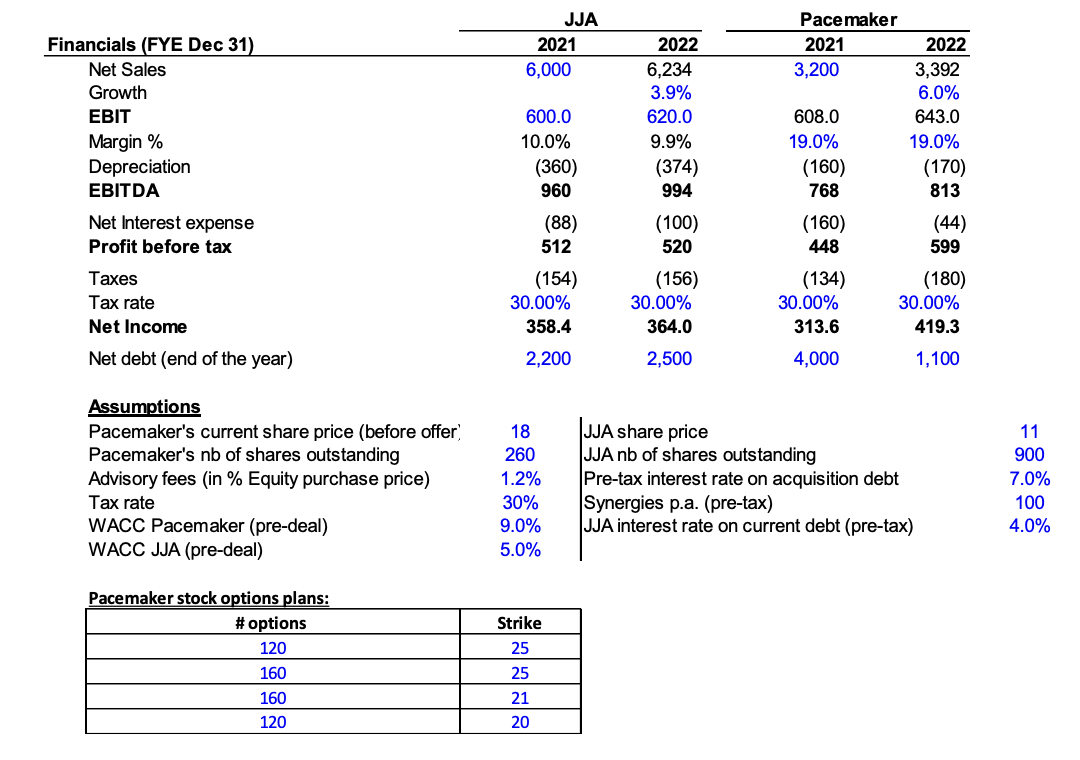

JJA SA launched an offer on Pacemaker Ltd on 1/1/22, offering Pacemakers shareholders a 60%/40%\ (share/cash) mixed offer with a 35% premium over Pacemaker current share price. Given all of Pacemakers\ debt has a change of control clause, Pacemakers net financial debt will need to be repaid straight away. JJA\ cannot use the cash on its balance sheet to finance the acquisition.\ Q1: What is the value paid by JJA for Pacemakers equity?\ Q2A: What is the offer per share made by JJA to Pacemaker shareholders?\ Q2B: cash per share \ Q2C: exchange ratio i.e Number of JJA share for 1 Pacemaker share (3 decimals)Pacemaker stock options plans:

JJA Pacemaker Financials (FYE Dec 31) 2021 2022 2021 2022 Net Sales 6,000 6,234 3,200 3,392 Growth 3.9% 6.0% EBIT 600.0 620.0 608.0 643.0 Margin % 10.0% 9.9% 19.0% 19.0% Depreciation (360) (374) (160) (170) EBITDA 960 994 768 813 Net Interest expense (88) (100) (160) (44) Profit before tax 512 520 448 599 Taxes (154) (156) (134) (180) Tax rate 30.00% 30.00% 30.00% 30.00% Net Income 358.4 364.0 313.6 419.3 Net debt (end of the year) 2,200 2,500 4,000 1,100 Assumptions Pacemaker's current share price (before offer) 18 JJA share price 11 Pacemaker's nb of shares outstanding Advisory fees (in % Equity purchase price) 260 1.2% Tax rate 30% JJA nb of shares outstanding Pre-tax interest rate on acquisition debt Synergies p.a. (pre-tax) 900 7.0% 100 WACC Pacemaker (pre-deal) 9.0% JJA interest rate on current debt (pre-tax) 4.0% WACC JJA (pre-deal) 5.0% Pacemaker stock options plans: # options Strike 120 25 160 25 160 21 120 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started