Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JK Engineering wants to invest in $12,000,000 in a new project that will increase EBIT by 27% of the cost of the project. The

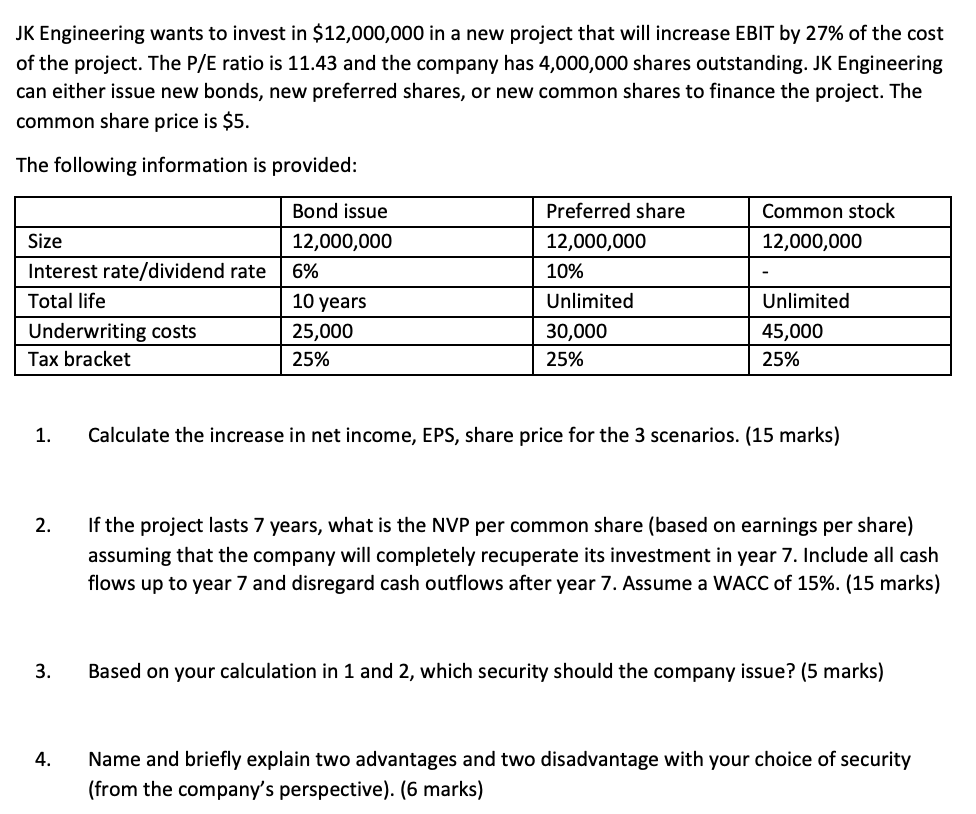

JK Engineering wants to invest in $12,000,000 in a new project that will increase EBIT by 27% of the cost of the project. The P/E ratio is 11.43 and the company has 4,000,000 shares outstanding. JK Engineering can either issue new bonds, new preferred shares, or new common shares to finance the project. The common share price is $5. The following information is provided: Bond issue Size 12,000,000 Interest rate/dividend rate 6% Total life 10 years Underwriting costs 25,000 Tax bracket 25% 1. Preferred share 12,000,000 10% Unlimited 30,000 25% Common stock 12,000,000 - Unlimited 45,000 25% Calculate the increase in net income, EPS, share price for the 3 scenarios. (15 marks) 2. If the project lasts 7 years, what is the NVP per common share (based on earnings per share) assuming that the company will completely recuperate its investment in year 7. Include all cash flows up to year 7 and disregard cash outflows after year 7. Assume a WACC of 15%. (15 marks) 3. Based on your calculation in 1 and 2, which security should the company issue? (5 marks) 4. Name and briefly explain two advantages and two disadvantage with your choice of security (from the company's perspective). (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

JK Engineering Investment Analysis 1 Increase in Net Income EPS and Share Price Scenario Increase in EBIT InterestDividend Expense Tax 25 Net Income I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started