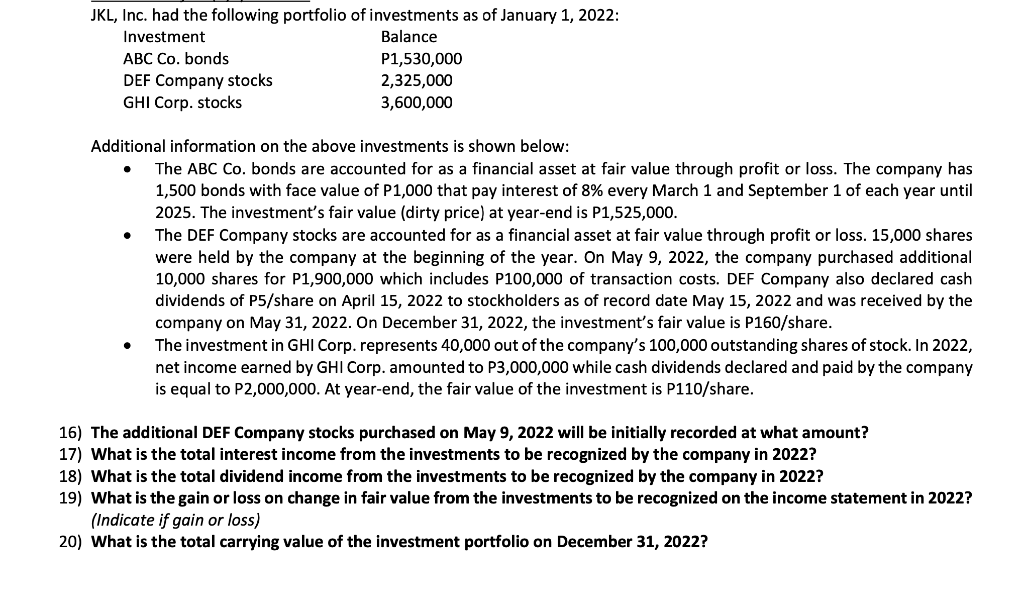

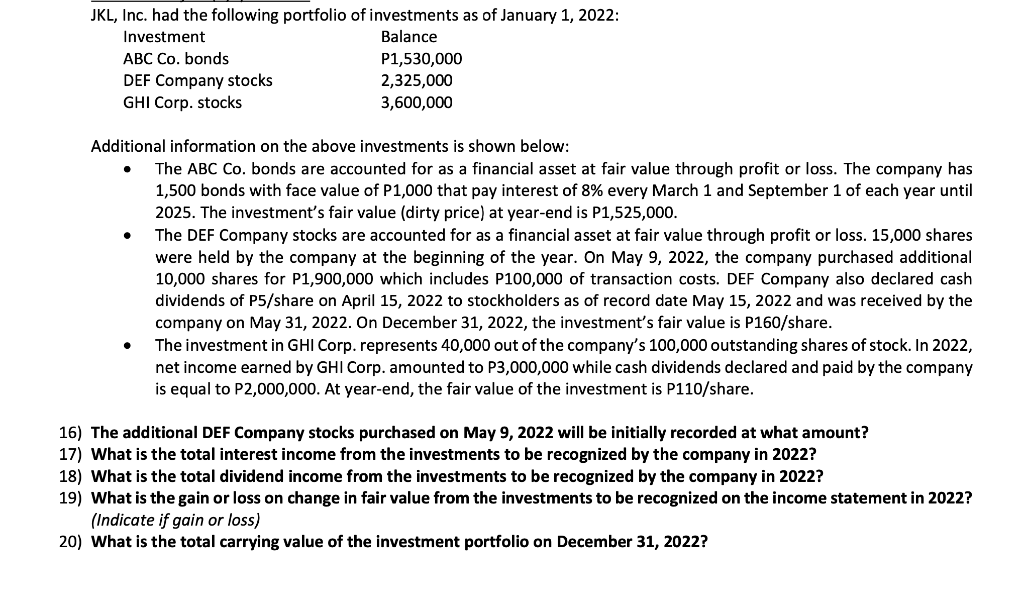

JKL, Inc. had the following portfolio of investments as of January 1, 2022: Investment Balance ABC Co. bonds P1,530,000 DEF Company stocks 2,325,000 GHI Corp. stocks 3,600,000 Additional information on the above investments is shown below: The ABC Co. bonds are accounted for as a financial asset at fair value through profit or loss. The company has 1,500 bonds with face value of P1,000 that pay interest of 8% every March 1 and September 1 of each year until 2025. The investment's fair value (dirty price) at year-end is P1,525,000. The DEF Company stocks are accounted for as a financial asset at fair value through profit or loss. 15,000 shares were held by the company at the beginning of the year. On May 9, 2022, the company purchased additional 10,000 shares for P1,900,000 which includes P100,000 of transaction costs. DEF Company also declared cash dividends of P5/share on April 15, 2022 to stockholders as of record date May 15, 2022 and was received by the company on May 31, 2022. On December 31, 2022, the investment's fair value is P160/share. The investment in GHI Corp. represents 40,000 out of the company's 100,000 outstanding shares of stock. In 2022, net income earned by GHI Corp. amounted to P3,000,000 while cash dividends declared and paid by the company is equal to P2,000,000. At year-end, the fair value of the investment is P110/share. 16) The additional DEF Company stocks purchased on May 9, 2022 will be initially recorded at what amount? 17) What is the total interest income from the investments to be recognized by the company in 2022? 18) What is the total dividend income from the investments to be recognized by the company in 2022? 19) What is the gain or loss on change in fair value from the investments to be recognized on the income statement in 2022? (Indicate if gain or loss) 20) What is the total carrying value of the investment portfolio on December 31, 2022? JKL, Inc. had the following portfolio of investments as of January 1, 2022: Investment Balance ABC Co. bonds P1,530,000 DEF Company stocks 2,325,000 GHI Corp. stocks 3,600,000 Additional information on the above investments is shown below: The ABC Co. bonds are accounted for as a financial asset at fair value through profit or loss. The company has 1,500 bonds with face value of P1,000 that pay interest of 8% every March 1 and September 1 of each year until 2025. The investment's fair value (dirty price) at year-end is P1,525,000. The DEF Company stocks are accounted for as a financial asset at fair value through profit or loss. 15,000 shares were held by the company at the beginning of the year. On May 9, 2022, the company purchased additional 10,000 shares for P1,900,000 which includes P100,000 of transaction costs. DEF Company also declared cash dividends of P5/share on April 15, 2022 to stockholders as of record date May 15, 2022 and was received by the company on May 31, 2022. On December 31, 2022, the investment's fair value is P160/share. The investment in GHI Corp. represents 40,000 out of the company's 100,000 outstanding shares of stock. In 2022, net income earned by GHI Corp. amounted to P3,000,000 while cash dividends declared and paid by the company is equal to P2,000,000. At year-end, the fair value of the investment is P110/share. 16) The additional DEF Company stocks purchased on May 9, 2022 will be initially recorded at what amount? 17) What is the total interest income from the investments to be recognized by the company in 2022? 18) What is the total dividend income from the investments to be recognized by the company in 2022? 19) What is the gain or loss on change in fair value from the investments to be recognized on the income statement in 2022? (Indicate if gain or loss) 20) What is the total carrying value of the investment portfolio on December 31, 2022