Answered step by step

Verified Expert Solution

Question

1 Approved Answer

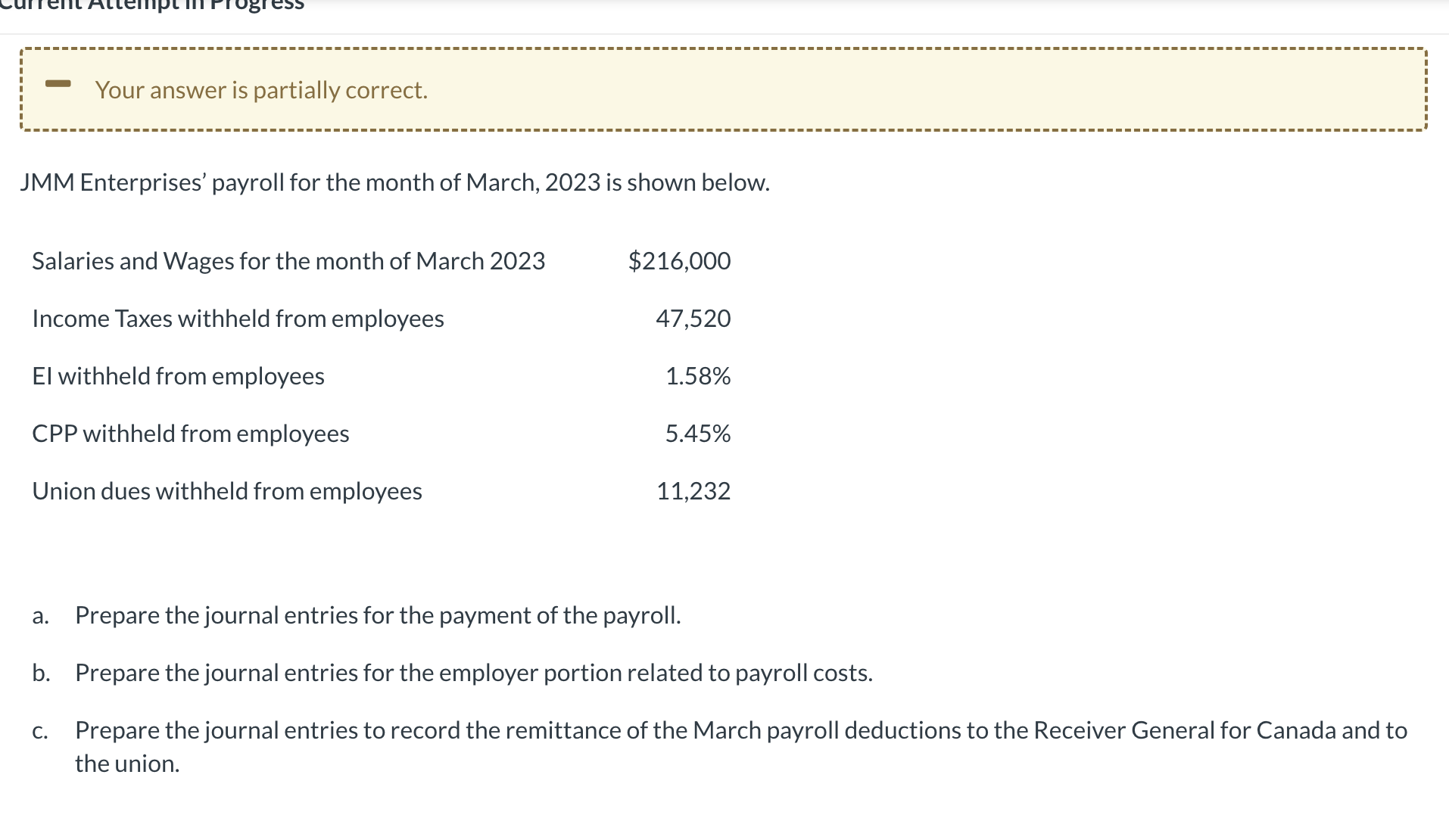

JMM Enterprises' payroll for the month of March, 2023 is shown below. a. Prepare the journal entries for the payment of the payroll. b. Prepare

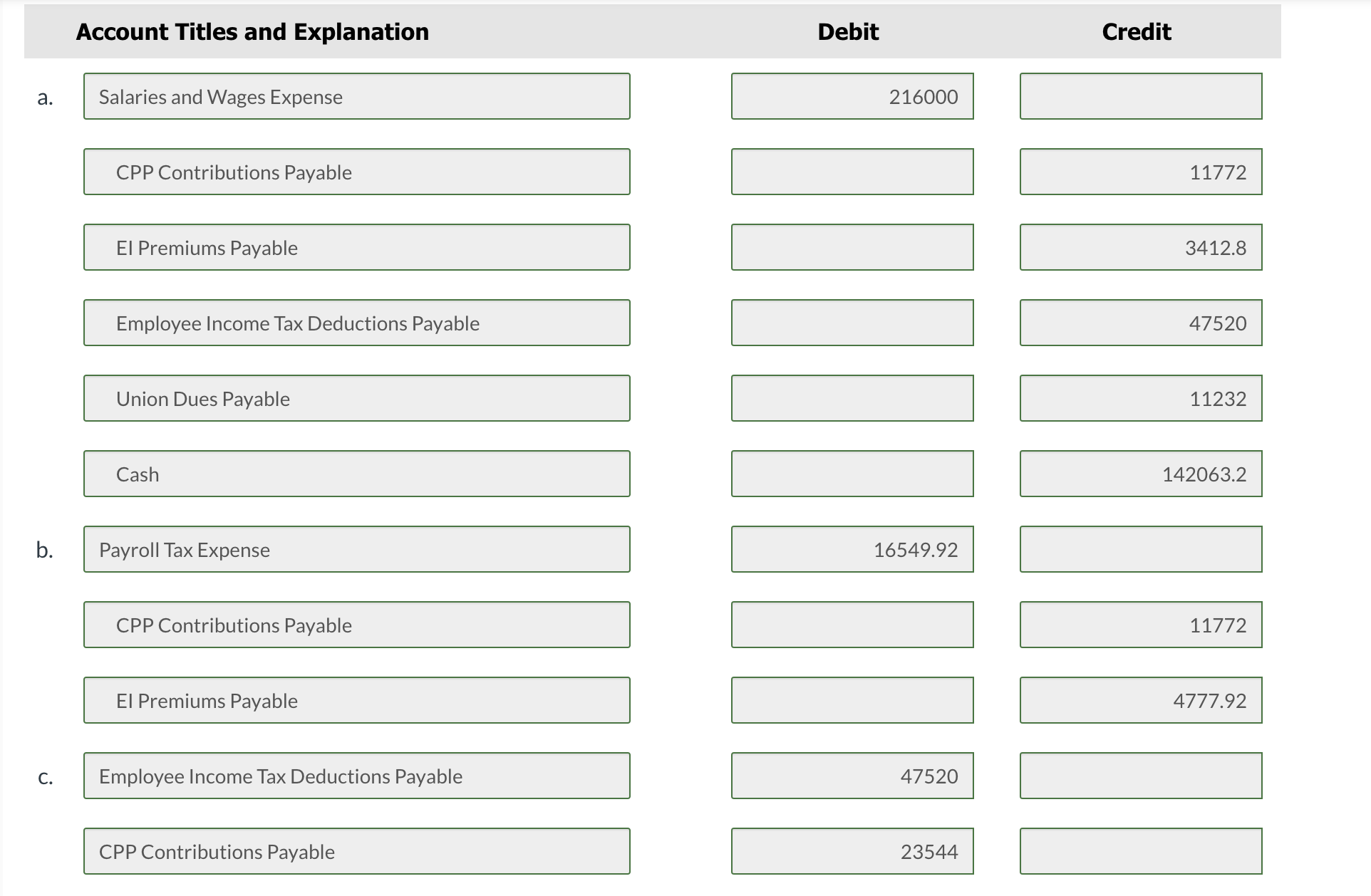

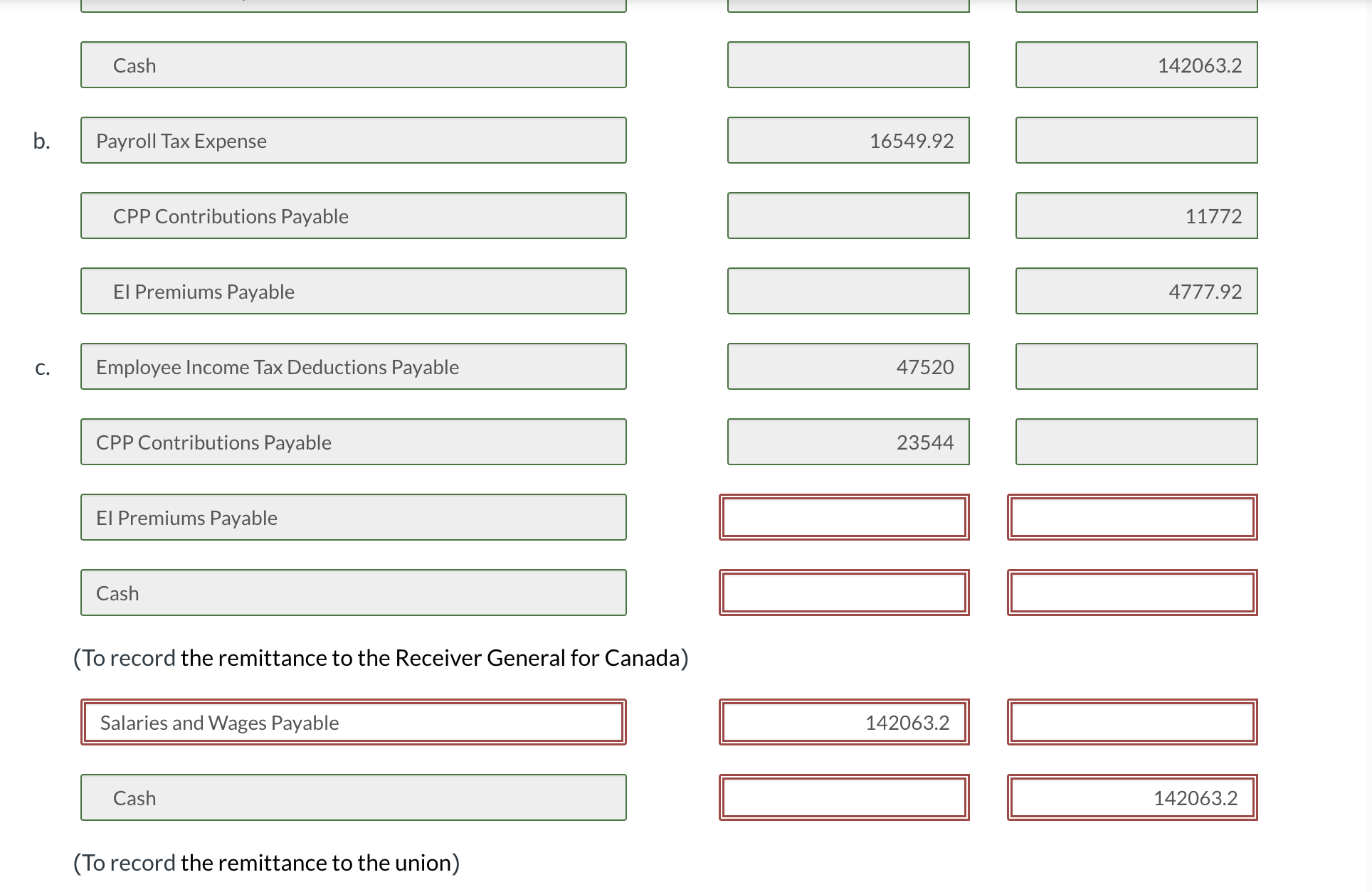

JMM Enterprises' payroll for the month of March, 2023 is shown below. a. Prepare the journal entries for the payment of the payroll. b. Prepare the journal entries for the employer portion related to payroll costs. c. Prepare the journal entries to record the remittance of the March payroll deductions to the Receiver General for Canada and to the union. Account Titles and Explanation a. Salaries and Wages Expense CPP Contributions Payable El Premiums Payable Employee Income Tax Deductions Payable Union Dues Payable Cash b. Payroll Tax Expense CPP Contributions Payable El Premiums Payable c. Employee Income Tax Deductions Payable CPP Contributions Payable Debit Credit 216000 \begin{tabular}{|r|} \hline \\ \hline \\ \hline 3412.8 \\ \hline 47520 \\ \hline 11232 \\ \hline \end{tabular} 142063.2 16549.92 11772 4777.92 47520 \begin{tabular}{r} 4777.92 \\ \hline \\ \\ \hline \end{tabular} 23544 Cash b. Payroll Tax Expense CPP Contributions Payable El Premiums Payable C. Employee Income Tax Deductions Payable CPP Contributions Payable El Premiums Payable Cash (To record the remittance to the Receiver General for Canada) Salaries and Wages Payable Cash (To record the remittance to the union) 16549.92 11772 4777.92 47520 23544

JMM Enterprises' payroll for the month of March, 2023 is shown below. a. Prepare the journal entries for the payment of the payroll. b. Prepare the journal entries for the employer portion related to payroll costs. c. Prepare the journal entries to record the remittance of the March payroll deductions to the Receiver General for Canada and to the union. Account Titles and Explanation a. Salaries and Wages Expense CPP Contributions Payable El Premiums Payable Employee Income Tax Deductions Payable Union Dues Payable Cash b. Payroll Tax Expense CPP Contributions Payable El Premiums Payable c. Employee Income Tax Deductions Payable CPP Contributions Payable Debit Credit 216000 \begin{tabular}{|r|} \hline \\ \hline \\ \hline 3412.8 \\ \hline 47520 \\ \hline 11232 \\ \hline \end{tabular} 142063.2 16549.92 11772 4777.92 47520 \begin{tabular}{r} 4777.92 \\ \hline \\ \\ \hline \end{tabular} 23544 Cash b. Payroll Tax Expense CPP Contributions Payable El Premiums Payable C. Employee Income Tax Deductions Payable CPP Contributions Payable El Premiums Payable Cash (To record the remittance to the Receiver General for Canada) Salaries and Wages Payable Cash (To record the remittance to the union) 16549.92 11772 4777.92 47520 23544 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started