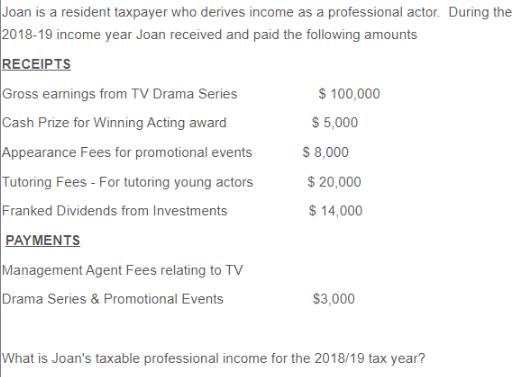

Joan is a resident taxpayer who derives income as a professional actor. During the 2018-19 income year Joan received and paid the following amounts

Joan is a resident taxpayer who derives income as a professional actor. During the 2018-19 income year Joan received and paid the following amounts RECEIPTS Gross earnings from TV Drama Series Cash Prize for Winning Acting award Appearance Fees for promotional events Tutoring Fees - For tutoring young actors Franked Dividends from Investments PAYMENTS Management Agent Fees relating to TV Drama Series & Promotional Events $ 100,000 $ 5,000 $ 8,000 $ 20,000 $ 14,000 $3,000 What is Joan's taxable professional income for the 2018/19 tax year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Joans taxable professional income for the 201819 tax year we need t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started