Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joan Kraft has always had a great love of flowers. After many years of working tirelessly for other unappreciative florists, she has worked up

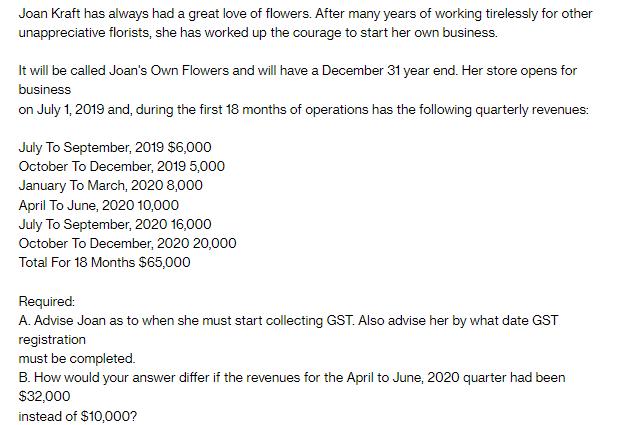

Joan Kraft has always had a great love of flowers. After many years of working tirelessly for other unappreciative florists, she has worked up the courage to start her own business. It will be called Joan's Own Flowers and will have a December 31 year end. Her store opens for business on July 1, 2019 and, during the first 18 months of operations has the following quarterly revenues: July To September, 2019 $6,000 October To December, 2019 5,000 January To March, 2020 8,000 April To June, 2020 10,000 July To September, 2020 16,000 October To December, 2020 20,000 Total For 18 Months $65,000 Required: A. Advise Joan as to when she must start collecting GST. Also advise her by what date GST registration must be completed. B. How would your answer differ if the revenues for the April to June, 2020 quarter had been $32,000 instead of $10,000?

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

A To determine when Joan must start collecting Goods and Services Tax GST we need to consider the revenue threshold set by the tax authorities The thr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started