Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Joanne Ackman is the owner of JCJ Inc. (JCJ), which provides residential landscaping services. Joanne and her husband, Carlos, each have a 33.3% interest

.

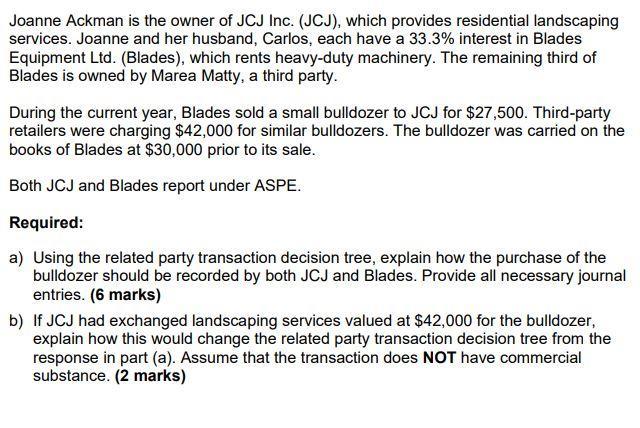

Joanne Ackman is the owner of JCJ Inc. (JCJ), which provides residential landscaping services. Joanne and her husband, Carlos, each have a 33.3% interest in Blades Equipment Ltd. (Blades), which rents heavy-duty machinery. The remaining third of Blades is owned by Marea Matty, a third party. During the current year, Blades sold a small bulldozer to JCJ for $27,500. Third-party retailers were charging $42,000 for similar bulldozers. The bulldozer was carried on the books of Blades at $30,000 prior to its sale. Both JCJ and Blades report under ASPE. Required: a) Using the related party transaction decision tree, explain how the purchase of the bulldozer should be recorded by both JCJ and Blades. Provide all necessary journal entries. (6 marks) b) If JCJ had exchanged landscaping services valued at $42,000 for the bulldozer, explain how this would change the related party transaction decision tree from the response in part (a). Assume that the transaction does NOT have commercial substance. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The purchase of the bulldozer should be recorded by both JCJ and Blades as an arms len...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started