Question

Joanne Krol wants to purchase a newer model automobile to replace her rusty 1989 car. The bank where Joanne has a checking account, US Bank,

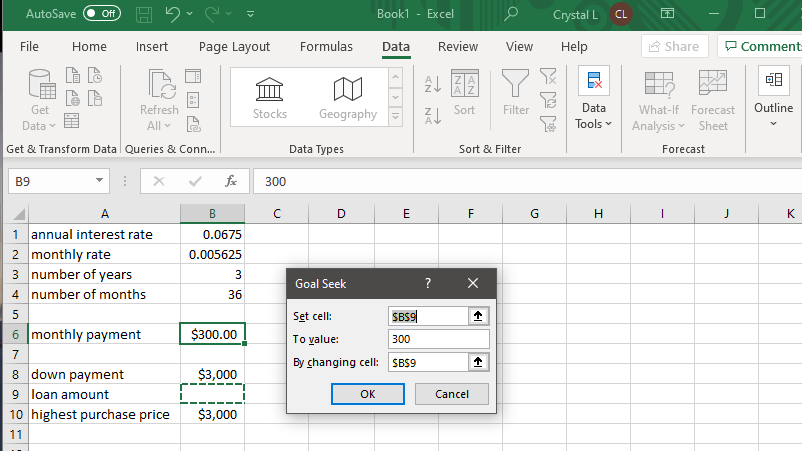

Joanne Krol wants to purchase a newer model automobile to replace her rusty 1989 car. The bank where Joanne has a checking account, US Bank, is advertising an annual interest rate of 6.75 percent for a three-year loan on used cars. By selling her old car and using some cash she has accumulated, Joanne has $3,000 available as a down payment. Under her current budget, Joanne figures that the maximum monthly loan payment she can afford is $300. She wants to find out the maximum car price she can afford and keep the monthly payment no higher than $300. She cannot alter the interest rate or the three-year term. Use the Excel Goal Seek command to figure out the highest purchase price Joanne can afford.

Can someone show me step by step how to use goal seek. How do I fill it in?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started