Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joanne Smith was born in 1948. John Smith, Joanne's husband, was born in 1940. They are both not blind. They gave these following people

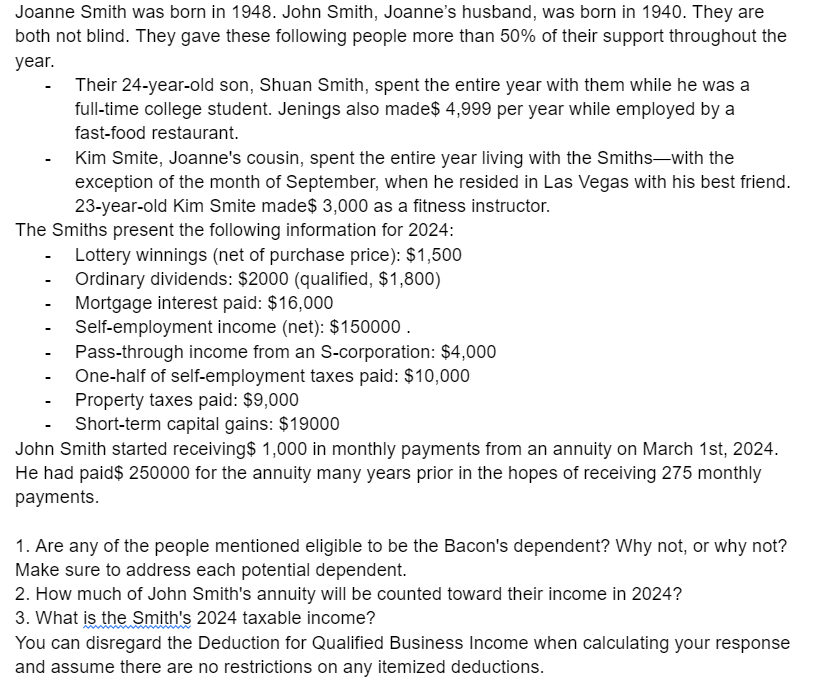

Joanne Smith was born in 1948. John Smith, Joanne's husband, was born in 1940. They are both not blind. They gave these following people more than 50% of their support throughout the year. Their 24-year-old son, Shuan Smith, spent the entire year with them while he was a full-time college student. Jenings also made$ 4,999 per year while employed by a fast-food restaurant. Kim Smite, Joanne's cousin, spent the entire year living with the Smithswith the exception of the month of September, when he resided in Las Vegas with his best friend. 23-year-old Kim Smite made$ 3,000 as a fitness instructor. The Smiths present the following information for 2024: Lottery winnings (net of purchase price): $1,500 - Ordinary dividends: $2000 (qualified, $1,800) - Mortgage interest paid: $16,000 - - Self-employment income (net): $150000. Pass-through income from an S-corporation: $4,000 - One-half of self-employment taxes paid: $10,000 - Property taxes paid: $9,000 Short-term capital gains: $19000 John Smith started receiving $ 1,000 in monthly payments from an annuity on March 1st, 2024. He had paid$ 250000 for the annuity many years prior in the hopes of receiving 275 monthly payments. 1. Are any of the people mentioned eligible to be the Bacon's dependent? Why not, or why not? Make sure to address each potential dependent. 2. How much of John Smith's annuity will be counted toward their income in 2024? 3. What is the Smith's 2024 taxable income? You can disregard the Deduction for Qualified Business Income when calculating your response and assume there are no restrictions on any itemized deductions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Shuan Smith is eligible to be the Smiths dependent as he is their son and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started