Answered step by step

Verified Expert Solution

Question

1 Approved Answer

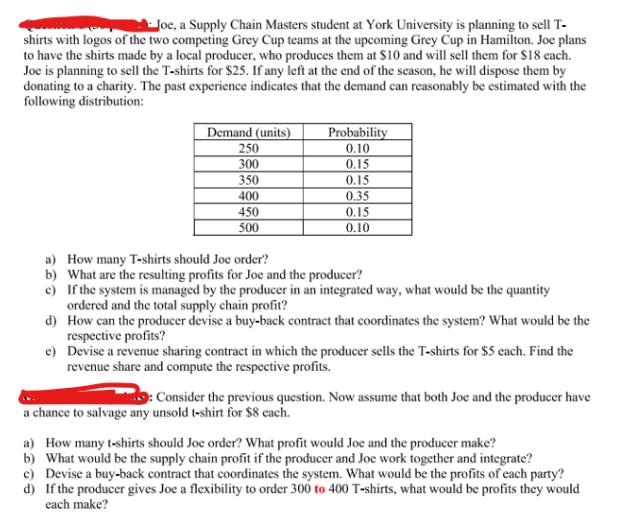

Joe, a Supply Chain Masters student at York University is planning to sell T- shirts with logos of the two competing Grey Cup teams

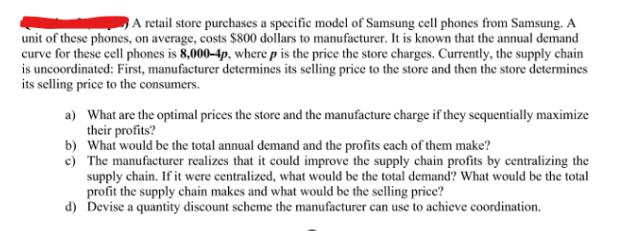

Joe, a Supply Chain Masters student at York University is planning to sell T- shirts with logos of the two competing Grey Cup teams at the upcoming Grey Cup in Hamilton. Joe plans to have the shirts made by a local producer, who produces them at $10 and will sell them for $18 each. Joe is planning to sell the T-shirts for $25. If any left at the end of the season, he will dispose them by donating to a charity. The past experience indicates that the demand can reasonably be estimated with the following distribution: Demand (units) 250 300 350 400 450 500 Probability 0.10 0.15 0.15 0.35 0.15 0.10 a) How many T-shirts should Joe order? b) What are the resulting profits for Joe and the producer? c) If the system is managed by the producer in an integrated way, what would be the quantity ordered and the total supply chain profit? d) How can the producer devise a buy-back contract that coordinates the system? What would be the respective profits? e) Devise a revenue sharing contract in which the producer sells the T-shirts for $5 each. Find the revenue share and compute the respective profits. a chance to salvage any unsold t-shirt for $8 each. Consider the previous question. Now assume that both Joe and the producer have a) How many t-shirts should Joe order? What profit would Joe and the producer make? b) What would be the supply chain profit if the producer and Joe work together and integrate? c) Devise a buy-back contract that coordinates the system. What would be the profits of each party? d) If the producer gives Joe a flexibility to order 300 to 400 T-shirts, what would be profits they would each make? A retail store purchases a specific model of Samsung cell phones from Samsung. A unit of these phones, on average, costs $800 dollars to manufacturer. It is known that the annual demand curve for these cell phones is 8,000-4p, where p is the price the store charges. Currently, the supply chain is uncoordinated: First, manufacturer determines its selling price to the store and then the store determines its selling price to the consumers. a) What are the optimal prices the store and the manufacture charge if they sequentially maximize their profits? b) What would be the total annual demand and the profits each of them make? c) The manufacturer realizes that it could improve the supply chain profits by centralizing the supply chain. If it were centralized, what would be the total demand? What would be the total profit the supply chain makes and what would be the selling price? d) Devise a quantity discount scheme the manufacturer can use to achieve coordination.

Step by Step Solution

★★★★★

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started