Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe and Jill Brydon are husband and wife. They are both residents of Australia for tax purposes. They formed a partnership on 1 July

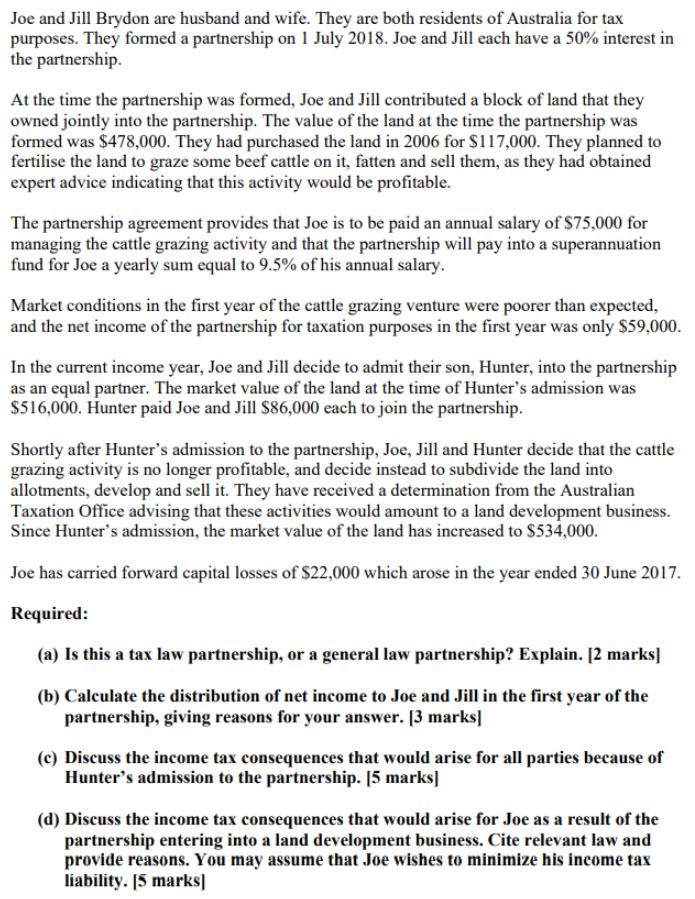

Joe and Jill Brydon are husband and wife. They are both residents of Australia for tax purposes. They formed a partnership on 1 July 2018. Joe and Jill each have a 50% interest in the partnership. At the time the partnership was formed, Joe and Jill contributed a block of land that they owned jointly into the partnership. The value of the land at the time the partnership was formed was $478,000. They had purchased the land in 2006 for $117,000. They planned to fertilise the land to graze some beef cattle on it, fatten and sell them, as they had obtained expert advice indicating that this activity would be profitable. The partnership agreement provides that Joe is to be paid an annual salary of $75,000 for managing the cattle grazing activity and that the partnership will pay into a superannuation fund for Joe a yearly sum equal to 9.5% of his annual salary. Market conditions in the first year of the cattle grazing venture were poorer than expected, and the net income of the partnership for taxation purposes in the first year was only $59,000. In the current income year, Joe and Jill decide to admit their son, Hunter, into the partnership as an equal partner. The market value of the land at the time of Hunter's admission was $516,000. Hunter paid Joe and Jill $86,000 each to join the partnership. Shortly after Hunter's admission to the partnership, Joe, Jill and Hunter decide that the cattle grazing activity is no longer profitable, and decide instead to subdivide the land into allotments, develop and sell it. They have received a determination from the Australian Taxation Office advising that these activities would amount to a land development business. Since Hunter's admission, the market value of the land has increased to $534,000. Joe has carried forward capital losses of $22,000 which arose in the year ended 30 June 2017. Required: (a) Is this a tax law partnership, or a general law partnership? Explain. [2 marks] (b) Calculate the distribution of net income to Joe and Jill in the first year of the partnership, giving reasons for your answer. [3 marks] (c) Discuss the income tax consequences that would arise for all parties because of Hunter's admission to the partnership. [5 marks] (d) Discuss the income tax consequences that would arise for Joe as a result of the partnership entering into a land development business. Cite relevant law and provide reasons. You may assume that Joe wishes to minimize his income tax liability. [5 marks]

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a This is a tax law partnership as it is formed for the purpose of carrying on a business The partne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started