Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe buys a $20,000 bond with a term of 20 years. The bond pays 4% simple interest. However, after Joe has held the bond for

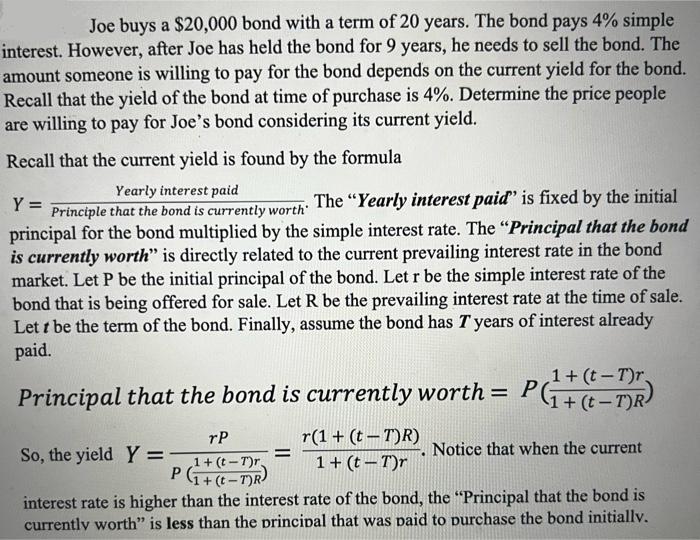

Joe buys a $20,000 bond with a term of 20 years. The bond pays 4% simple interest. However, after Joe has held the bond for 9 years, he needs to sell the bond. The amount someone is willing to pay for the bond depends on the current yield for the bond. Recall that the yield of the bond at time of purchase is 4%. Determine the price people are willing to pay for Joe's bond considering its current yield. Recall that the current yield is found by the formula Yearly interest paid Y = The "Yearly interest paid' is fixed by the initial Principle that the bond is currently worth principal for the bond multiplied by the simple interest rate. The "Principal that the bond is currently worth" is directly related to the current prevailing interest rate in the bond market. Let P be the initial principal of the bond. Let r be the simple interest rate of the bond that is being offered for sale. Let R be the prevailing interest rate at the time of sale. Lett be the term of the bond. Finally, assume the bond has 7 years of interest already paid. Principal that the bond is currently worth = r(1 + (t-T)R) 1+ (t-T)r So, the yield Y= rP 1+ (t-T)r. P ( + (t-T)R) 1+ (t-T)r. 1 + (tT)R) P(+ Notice that when the current interest rate is higher than the interest rate of the bond, the "Principal that the bond is currently worth" is less than the principal that was paid to purchase the bond initially.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started