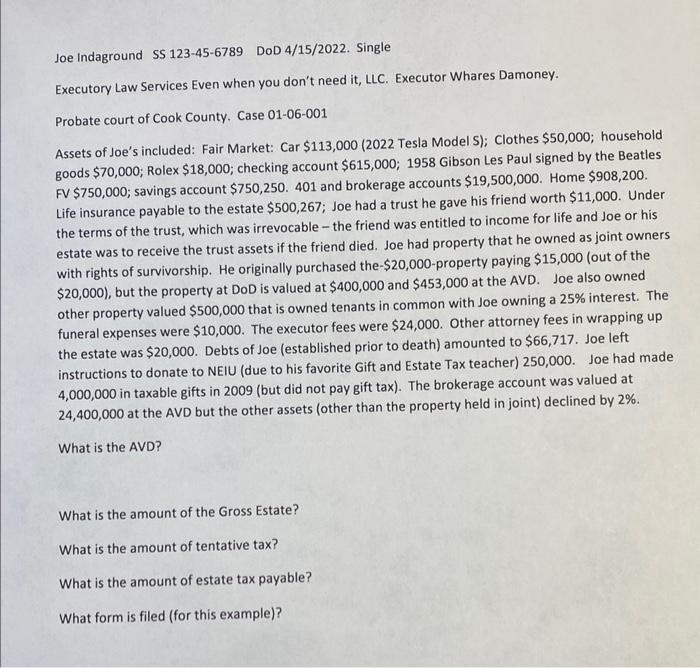

Joe Indaground SS 123-45-6789 DoD 4/15/2022. Single Executory Law Services Even when you don't need it, LLC. Executor Whares Damoney. Probate court of Cook County. Case 01-06-001 Assets of Joe's included: Fair Market: Car $113,000 (2022 Tesla Model S); Clothes $50,000; household goods $70,000; Rolex $18,000; checking account $615,000;1958 Gibson Les Paul signed by the Beatles FV $750,000; savings account $750,250. 401 and brokerage accounts $19,500,000. Home $908,200. Life insurance payable to the estate $500,267; Joe had a trust he gave his friend worth $11,000. Under the terms of the trust, which was irrevocable - the friend was entitled to income for life and Joe or his estate was to receive the trust assets if the friend died. Joe had property that he owned as joint owners with rights of survivorship. He originally purchased the- $20,000-property paying $15,000 (out of the $20,000), but the property at DoD is valued at $400,000 and $453,000 at the AVD. Joe also owned other property valued $500,000 that is owned tenants in common with Joe owning a 25% interest. The funeral expenses were $10,000. The executor fees were $24,000. Other attorney fees in wrapping up the estate was $20,000. Debts of Joe (established prior to death) amounted to $66,717. Joe left instructions to donate to NEIU (due to his favorite Gift and Estate Tax teacher) 250,000. Joe had made 4,000,000 in taxable gifts in 2009 (but did not pay gift tax). The brokerage account was valued at 24,400,000 at the AVD but the other assets (other than the property held in joint) declined by 2%. Joe Indaground SS 123-45-6789 DoD 4/15/2022. Single Executory Law Services Even when you don't need it, LLC. Executor Whares Damoney. Probate court of Cook County. Case 01-06-001 Assets of Joe's included: Fair Market: Car $113,000 (2022 Tesla Model S); Clothes $50,000; household goods $70,000; Rolex $18,000; checking account $615,000;1958 Gibson Les Paul signed by the Beatles FV $750,000; savings account $750,250. 401 and brokerage accounts $19,500,000. Home $908,200. Life insurance payable to the estate $500,267; Joe had a trust he gave his friend worth $11,000. Under the terms of the trust, which was irrevocable - the friend was entitled to income for life and Joe or his estate was to receive the trust assets if the friend died. Joe had property that he owned as joint owners with rights of survivorship. He originally purchased the- $20,000-property paying $15,000 (out of the $20,000), but the property at DoD is valued at $400,000 and $453,000 at the AVD. Joe also owned other property valued $500,000 that is owned tenants in common with Joe owning a 25% interest. The funeral expenses were $10,000. The executor fees were $24,000. Other attorney fees in wrapping up the estate was $20,000. Debts of Joe (established prior to death) amounted to $66,717. Joe left instructions to donate to NEIU (due to his favorite Gift and Estate Tax teacher) 250,000. Joe had made 4,000,000 in taxable gifts in 2009 (but did not pay gift tax). The brokerage account was valued at 24,400,000 at the AVD but the other assets (other than the property held in joint) declined by 2%