Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe Kane is an analyst at Oasis Investment Group. Kane is helping the portfolio manager to select and analyze bonds for possible inclusion in

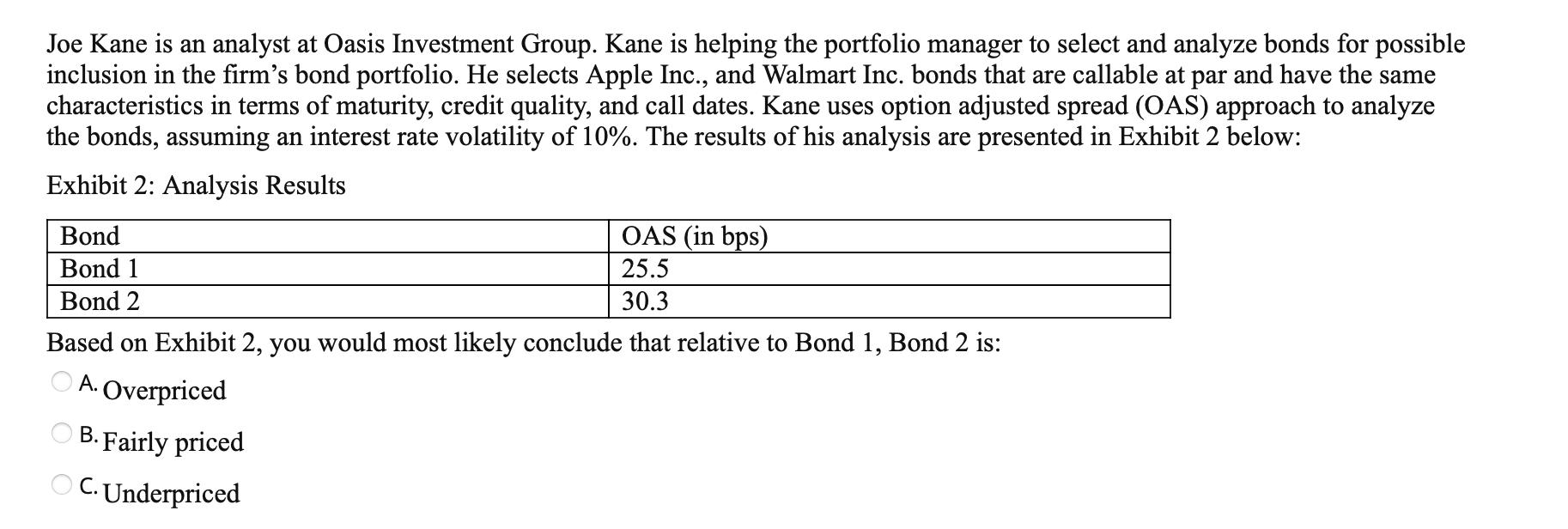

Joe Kane is an analyst at Oasis Investment Group. Kane is helping the portfolio manager to select and analyze bonds for possible inclusion in the firm's bond portfolio. He selects Apple Inc., and Walmart Inc. bonds that are callable at par and have the same characteristics in terms of maturity, credit quality, and call dates. Kane uses option adjusted spread (OAS) approach to analyze the bonds, assuming an interest rate volatility of 10%. The results of his analysis are presented in Exhibit 2 below: Exhibit 2: Analysis Results OAS (in bps) 25.5 30.3 Based on Exhibit 2, you would most likely conclude that relative to Bond 1, Bond 2 is: A. Overpriced B. Fairly priced C. Underpriced Bond Bond 1 Bond 2

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is A Overpriced E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started