Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe wants to start a savings plan to pay for his children's anticipated college educations. Based on current forecasts, Joe's expenditures on his elder

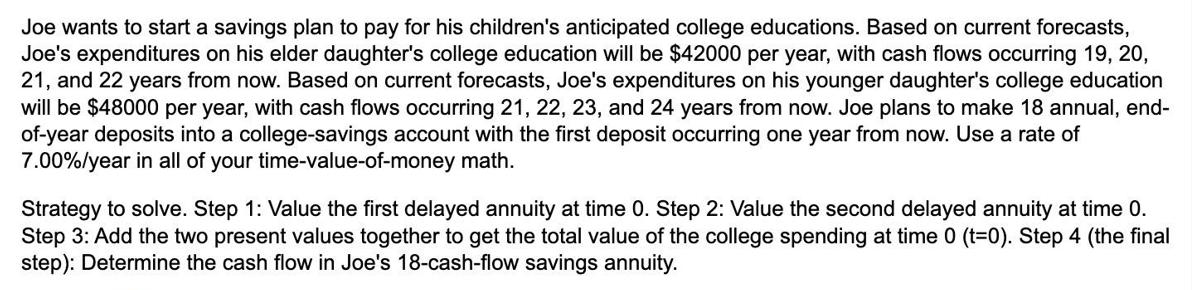

Joe wants to start a savings plan to pay for his children's anticipated college educations. Based on current forecasts, Joe's expenditures on his elder daughter's college education will be $42000 per year, with cash flows occurring 19, 20, 21, and 22 years from now. Based on current forecasts, Joe's expenditures on his younger daughter's college education will be $48000 per year, with cash flows occurring 21, 22, 23, and 24 years from now. Joe plans to make 18 annual, end- of-year deposits into a college-savings account with the first deposit occurring one year from now. Use a rate of 7.00%/year in all of your time-value-of-money math. Strategy to solve. Step 1: Value the first delayed annuity at time 0. Step 2: Value the second delayed annuity at time 0. Step 3: Add the two present values together to get the total value of the college spending at time 0 (t=0). Step 4 (the final step): Determine the cash flow in Joe's 18-cash-flow savings annuity.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the present value of two delayed annuities one for each d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started