Question

Joel and Jenny, age 30, have a $500,000 mortgage which will be paid off in 20 years. This mortgage keeps their cash flow very

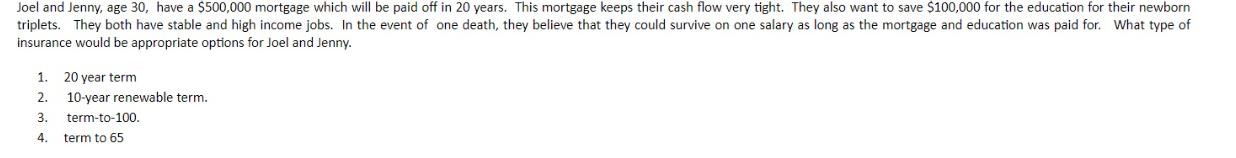

Joel and Jenny, age 30, have a $500,000 mortgage which will be paid off in 20 years. This mortgage keeps their cash flow very tight. They also want to save $100,000 for the education for their newborn triplets. They both have stable and high income jobs. In the event of one death, they believe that they could survive on one salary as long as the mortgage and education was paid for. What type of insurance would be appropriate options for Joel and Jenny. 1. 20 year term 2. 3. term-to-100. 4. term to 65 10-year renewable term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In order to determine the appropriate type of insurance for Joel and Jenny we need to consider their needs financial goals and risk tolerance Given th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App