Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joel and Trish are married, have two children, and recently bought a house. Trish has stable employment with above average income and excellent group

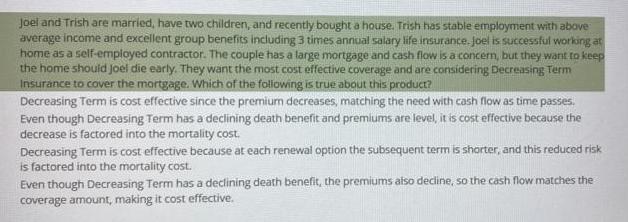

Joel and Trish are married, have two children, and recently bought a house. Trish has stable employment with above average income and excellent group benefits including 3 times annual salary life insurance. Joel is successful working at home as a self-employed contractor. The couple has a large mortgage and cash flow is a concern, but they want to keep the home should Joel die early. They want the most cost effective coverage and are considering Decreasing Term Insurance to cover the mortgage. Which of the following is true about this product? Decreasing Term is cost effective since the premium decreases, matching the need with cash flow as time passes. Even though Decreasing Term has a declining death benefit and premiums are level, it is cost effective because the decrease is factored into the mortality cost. Decreasing Term is cost effective because at each renewal option the subsequent term is shorter, and this reduced risk is factored into the mortality cost. Even though Decreasing Term has a declining death benefit, the premiums also decline, so the cash flow matches the coverage amount, making it cost effective.

Step by Step Solution

★★★★★

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The correct choice is b Something or someone who is considered to be of high...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started