Answered step by step

Verified Expert Solution

Question

1 Approved Answer

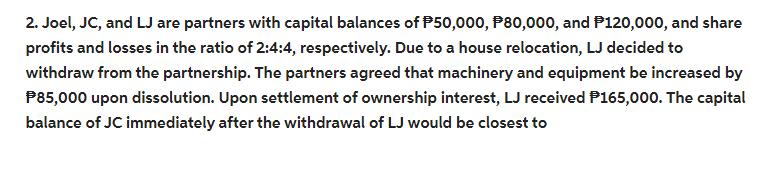

Joel, JC, and LJ are partners with capital balances of $50,000, P80,000, and $120,000, and share profits and losses in the ratio of 2:4:4,

Joel, JC, and LJ are partners with capital balances of $50,000, P80,000, and $120,000, and share profits and losses in the ratio of 2:4:4, respectively. Due to a house relocation, LJ decided to withdraw from the partnership. The partners agreed that machinery and equipment be increased by P85,000 upon dissolution. Upon settlement of ownership interest, LJ received P165,000. The capital balance of JC immediately after the withdrawal of LJ would be closest to

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started