Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joey Co. follows IFRS and has a December 31 year end. Joey purchased 200 common shares of Chet Inc. on July 1, 2020 paying

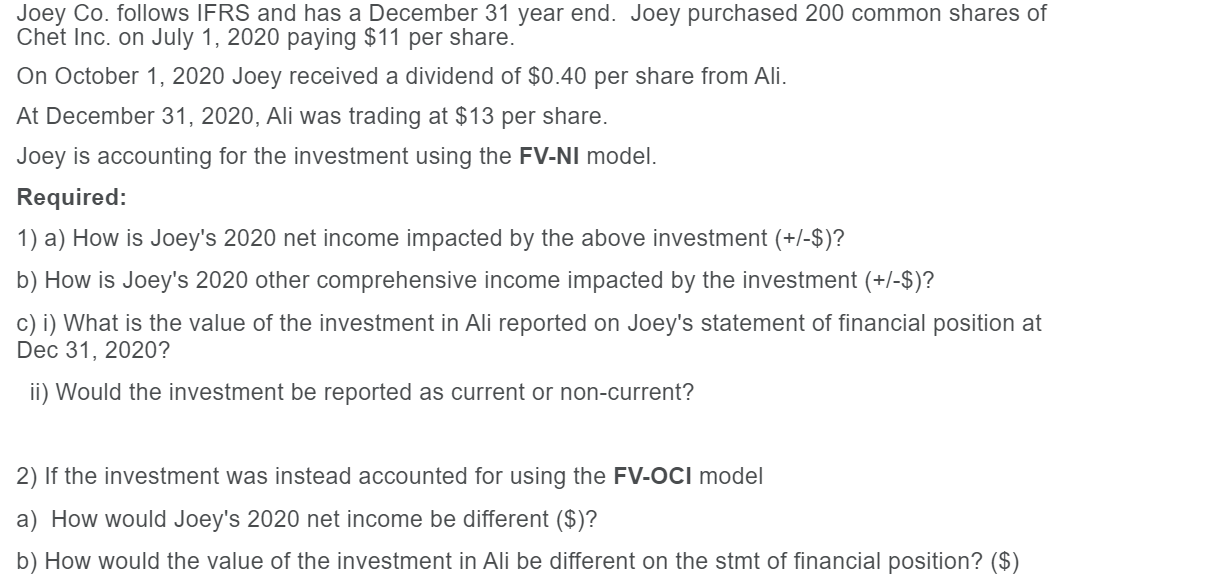

Joey Co. follows IFRS and has a December 31 year end. Joey purchased 200 common shares of Chet Inc. on July 1, 2020 paying $11 per share. On October 1, 2020 Joey received a dividend of $0.40 per share from Ali. At December 31, 2020, Ali was trading at $13 per share. Joey is accounting for the investment using the FV-NI model. Required: 1) a) How is Joey's 2020 net income impacted by the above investment (+/-$)? b) How is Joey's 2020 other comprehensive income impacted by the investment (+/-$)? c) i) What is the value of the investment in Ali reported on Joey's statement of financial position at Dec 31, 2020? ii) Would the investment be reported as current or non-current? 2) If the investment was instead accounted for using the FV-OCI model a) How would Joey's 2020 net income be different ($)? b) How would the value of the investment in Ali be different on the stmt of financial position? ($)

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1a Joeys 2020 net income is impacted by the investment as follows On July 1 2020 Joey paid 11 per sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started