Question

Johanna is grain farmer in Grand Island, NE. Last fall, she decided to sell her corn before harvest for delivery in March 2023. On August

Johanna is grain farmer in Grand Island, NE. Last fall, she decided to sell her corn before harvest for delivery in March 2023. On August 1, 2022 she sold her grain using futures contracts for March 2023 delivery. She locked in a futures price of $6.16/bu. Then, in March 2023 she delivered her grain, offset her hedge, got paid and was done with her corn harvested last year.

Now, after she delivered her grain in March 2023, her friend told her that she should have rolled her hedge forward to May 2023 delivery. According to her friend, she would have made more money if she had rolled her hedge. In fact, Johanna would have no problem in waiting until May 2023 to deliver her grain and get paid, as long as she had the opportunity to obtain a higher price at the end of the hedge. She just didn't consider doing it.

Let's see if her friend was right, i.e. let's see if Johanna should have rolled her hedge forward from March 2023 to May 2023 delivery.

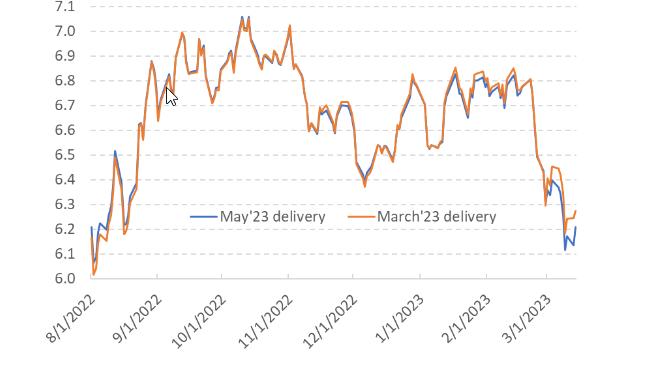

[a] The chart below shows corn futures prices for March 2023 delivery (orange line) and May 2023 delivery (blue line) between 8/1/2022 (which was the day Johanna started her hedge) and 3/14/2023 (which was the last trading day for the futures contract for March 2023 delivery). Futures prices are in $/bu.

[b] Now the chart below shows the spread between the futures price for May 2023 delivery and the futures price for March 2023 delivery (i.e. futures price for May 2023 delivery minus futures price for March 2023 delivery) between 10/4/2021 and 3/14/2022. For example, on 8/1/2022 (first point on the left) the spread was +$0.04/bu, which means that the futures price for May 2023 delivery was $0.04/bu higher than the futures price for March 2023 delivery. On 3/14/2023 (last point on the right) the spread was -$0.07/bu, which means that the futures price for May 2023 delivery was $0.07/bu lower than the futures price for March 2023 delivery.

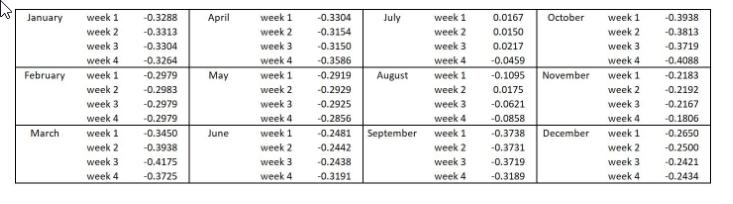

[b] Now the chart below shows the spread between the futures price for May 2023 delivery and the futures price for March 2023 delivery (i.e. futures price for May 2023 delivery minus futures price for March 2023 delivery) between 10/4/2021 and 3/14/2022. For example, on 8/1/2022 (first point on the left) the spread was +$0.04/bu, which means that the futures price for May 2023 delivery was $0.04/bu higher than the futures price for March 2023 delivery. On 3/14/2023 (last point on the right) the spread was -$0.07/bu, which means that the futures price for May 2023 delivery was $0.07/bu lower than the futures price for March 2023 delivery. [c] The table below shows the basis in Grand Island, NE (which is Johanna's cash market) as the average for the last 5 years (2018-2022). We can see the 5-year average basis for each week of the year. Since we are trying to figure out whether Johanna should have rolled her hedge forward from March 2023 to May 2023 delivery, we are mostly interested in comparing how the basis in her cash market changes between these two months.

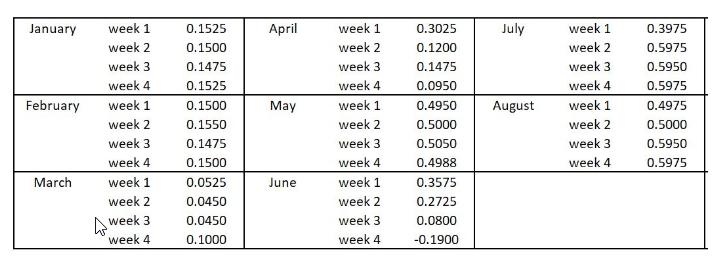

[c] The table below shows the basis in Grand Island, NE (which is Johanna's cash market) as the average for the last 5 years (2018-2022). We can see the 5-year average basis for each week of the year. Since we are trying to figure out whether Johanna should have rolled her hedge forward from March 2023 to May 2023 delivery, we are mostly interested in comparing how the basis in her cash market changes between these two months. [d] Now the table below shows the corn basis in Grand Island, NE (which is Johanna's cash market) this year (2023). We can see the basis for each week of 2023 from January until August.

[d] Now the table below shows the corn basis in Grand Island, NE (which is Johanna's cash market) this year (2023). We can see the basis for each week of 2023 from January until August.

[e] Finally, assume that: the cost of carry for Johanna was $0.04/bu/month, and the transaction fee to trade futures contracts was $0.01/bu.

Question one

As explained above, Johanna placed her hedge on 8/1/2022 using futures contracts for March 2023 delivery. Then she harvested her grain in the fall and stored it. Let's say she stored her grain for 5 months after harvest. Moving forward, Johanna delivered her grain in the second week of March 2023 and offset her hedge.

Using the information provided above, calculate Johanna's realized price for this hedge. Remember to account for storage and transaction fees too.

Question two

Now, we also learned that Johanna's friend had said that she should have rolled her hedge forward from March 2023 to May 2023 delivery. Based on all information above, do you agree with Johanna's friend? Do you think that, at some point between 8/1/2022 (when she started her hedge for March 2023 delivery) and 3/14/2023 (last trading day of the futures contract for March 2023 delivery), it would have been more profitable for Johanna to have rolled her hedge forward? Explain your answer and make sure to take into account all variables involved in this decision.

7.1 7.0 6.9 6.8 6.7 6.6 6.5 6.4 6.3 6.2 6.1 6.0 8/1/2022 9/1/2022 Mit 10/1/2022 mamy -May'23 delivery 11/1/2022 12/1/2022 -March'23 delivery 1/1/2023 3/1/2023 2/1/2023

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Johannas realized price for her hedge we need to consider several factors including the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started