Answered step by step

Verified Expert Solution

Question

1 Approved Answer

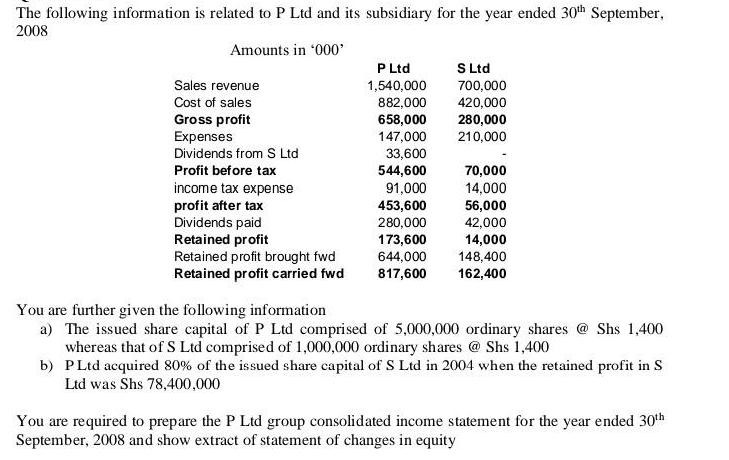

The following information is related to P Ltd and its subsidiary for the year ended 30th September, 2008 Amounts in '000' Sales revenue Cost

The following information is related to P Ltd and its subsidiary for the year ended 30th September, 2008 Amounts in '000' Sales revenue Cost of sales Gross profit Expenses Dividends from S Ltd Profit before tax income tax expense profit after tax Dividends paid Retained profit Retained profit brought fwd Retained profit carried fwd P Ltd 1,540,000 882,000 658,000 147,000 33,600 544,600 91,000 453,600 280,000 173,600 644,000 817,600 S Ltd 700,000 420,000 280,000 210,000 70,000 14,000 56,000 42,000 14,000 148,400 162,400 You are further given the following information a) The issued share capital of P Ltd comprised of 5,000,000 ordinary shares @ Shs 1,400 whereas that of S Ltd comprised of 1,000,000 ordinary shares @ Shs 1,400 b) PLtd acquired 80% of the issued share capital of S Ltd in 2004 when the retained profit in S Ltd was Shs 78,400,000 You are required to prepare the P Ltd group consolidated income statement for the year ended 30th September, 2008 and show extract of statement of changes in equity

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

A CONSOLIDATED INCOME STATEMENT FOR THE YEAR ENDED 30TH SEPTEMBER 2008 Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started