Question

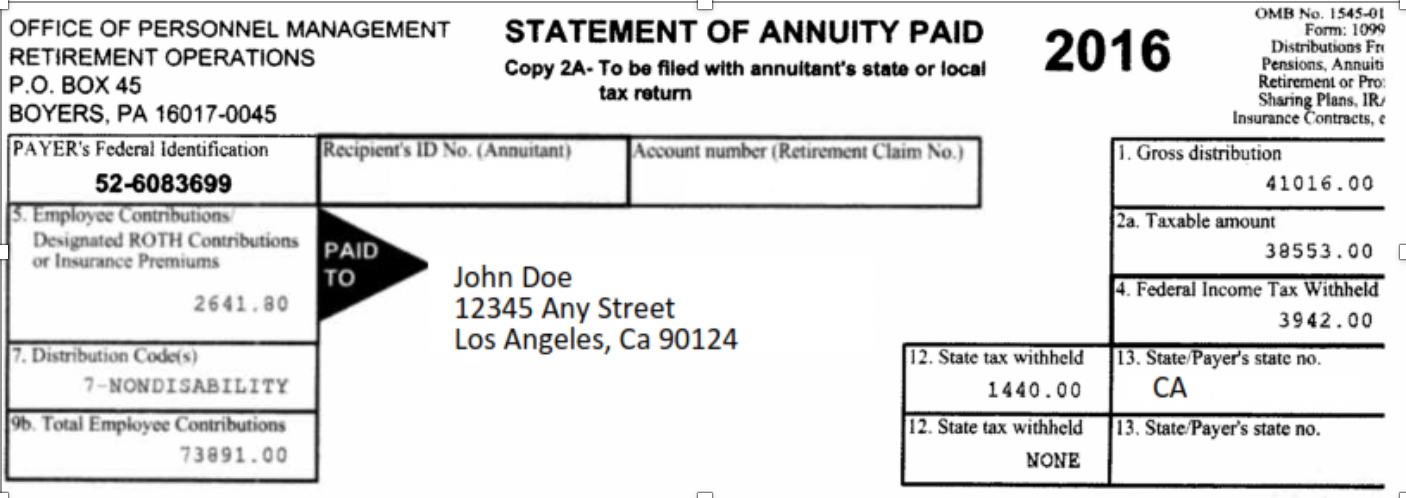

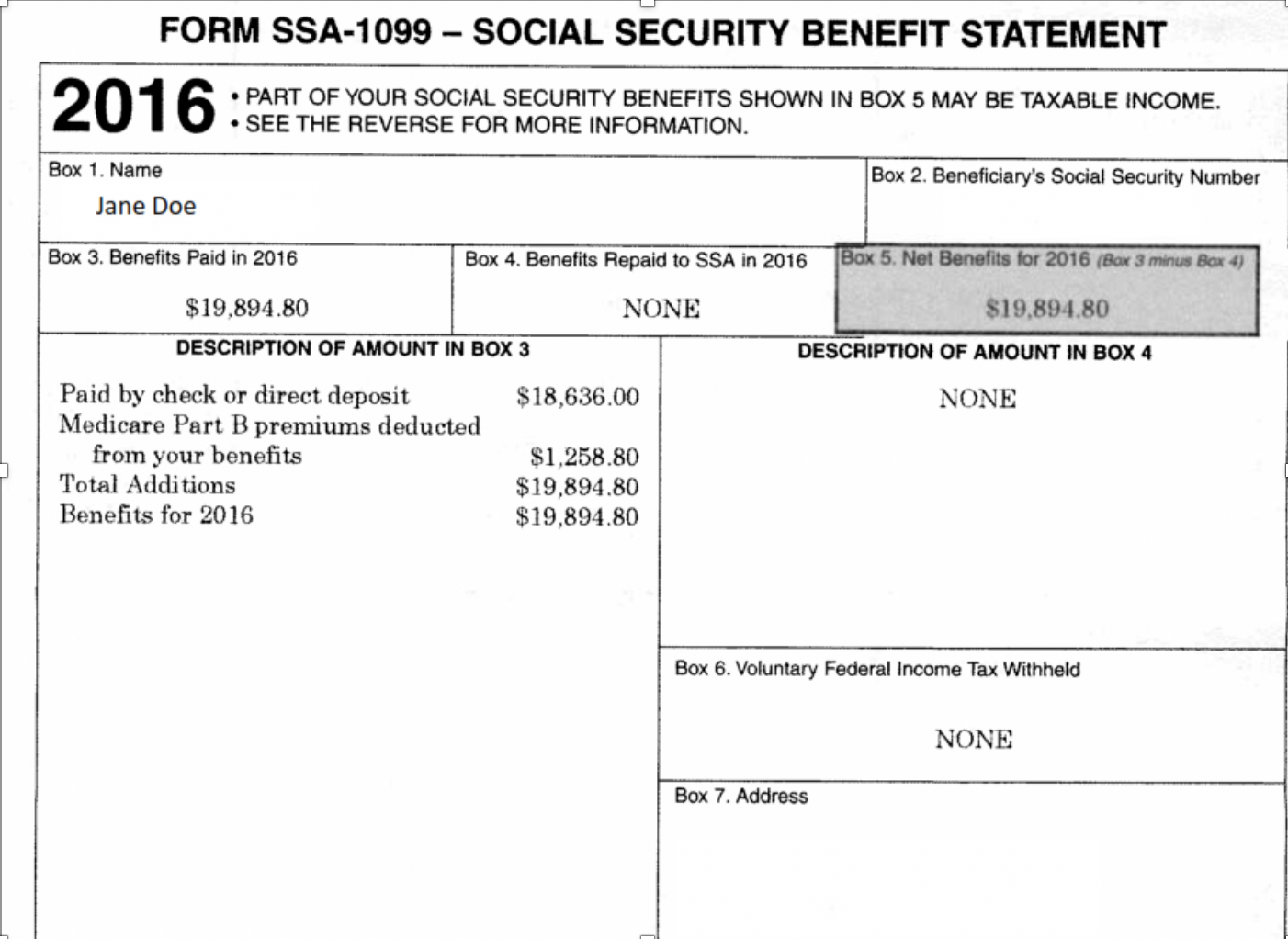

John and Jane Doe are married retired taxpayers who care for their three-year-old grandson. The following information was provided to you as documentation necessary to

John and Jane Doe are married retired taxpayers who care for their three-year-old grandson. The following information was provided to you as documentation necessary to prepare their 2017 tax return. You will gather the appropriate information and complete the forms provided in Blackboard (1040, Schedule A, Schedule B and Schedule D) in preparation of their tax file. Please note that the forms provided may not match the tax year of the course, as IRS forms are not available until just before the start of the filing season, and this course generally is approximately a year ahead of the actual form releases. Therefore, do not worry about the year on top of the forms, but utilize information for the current year of the textbook in use for this course when determining deduction amounts, exemption amounts, and tax rates.

Taxpayer:

Name:?John Doe

DOB:?6/29/1950

SSN:?555-12-345

Spouse:

Name:?Jane Doe

DOB:?7/4/1948

SSN:?555-65-4321

Dependent:

Name:?Jimmy Doe

DOB:?1/12/2014

SSN:?555-68-9101

Mailing Address:

12345 Any Street ? ? ? ? ??

Los Angeles, Ca 90124

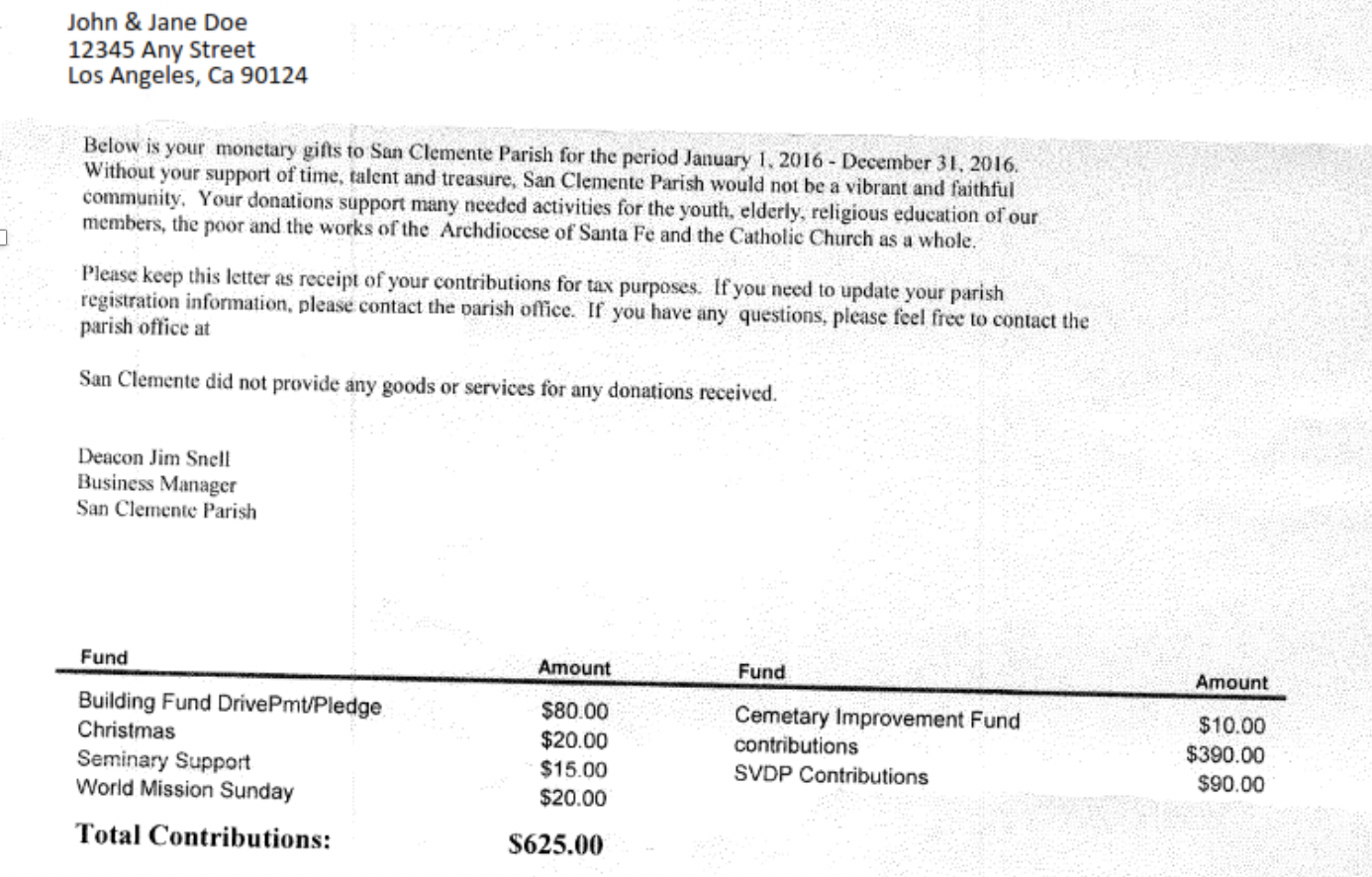

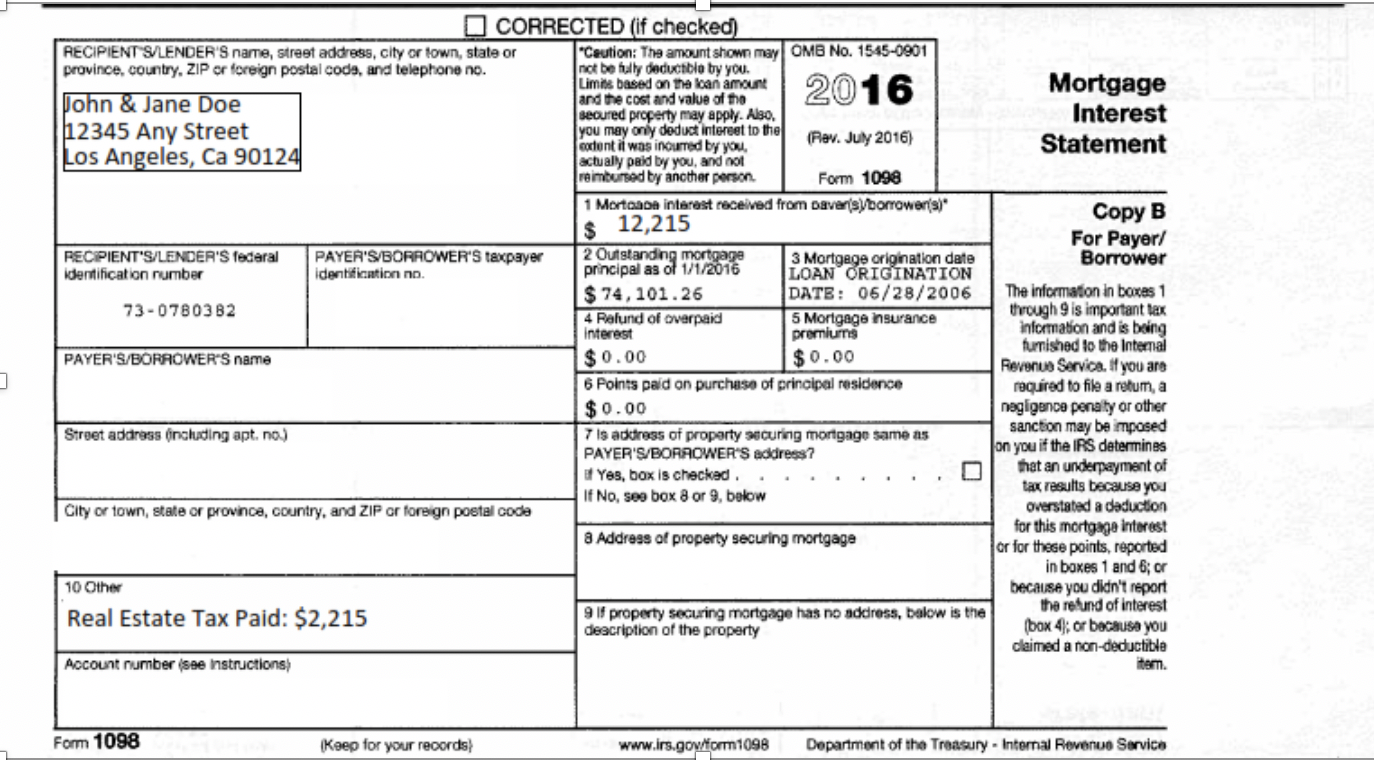

Deductions

Prescription Medication: $638

Doctor?s Visits: $2,904

Insurance Premiums out of pocket (not including Medicare premiums deducted from social security): $5,125

Medical Miles Driven: 410

Deductible DMV registration fees: $170

Income:

Received a gift from Jane?s mother, $12,000

Sold Stock with a basis of $10,000 for $13,500. Held the stock for more than one year

Sold stock with a basis of $5,000 for $5,500. Held the stock for less than one year.

Finally, all three members of the family had qualifying health insurance for the entire year.

Complete the four (4) attached forms (1040.pdf, Schedule A.pdf, Schedule B.pdf, Schedule D.pdf).?

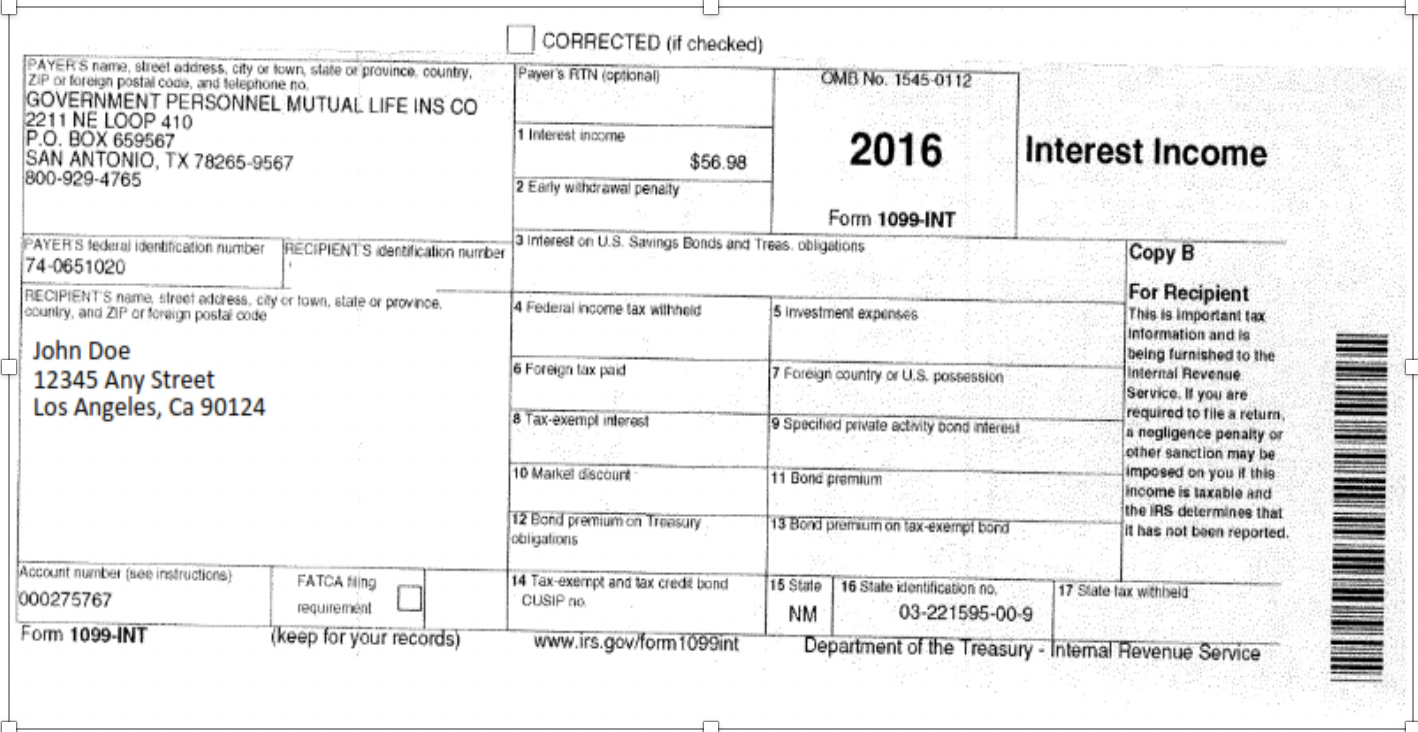

??PAYERS name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. GOVERNMENT PERSONNEL MUTUAL LIFE INS CO 2211 NE LOOP 410 P.O. BOX 659567 SAN ANTONIO, TX 78265-9567 800-929-4765 PAYER'S federal identification number 74-0651020 RECIPIENT'S name, street address, city or town, state or province. country, and ZIP or foreign postal code John Doe 12345 Any Street Los Angeles, Ca 90124 Account number (see instructions) 000275767 Form 1099-INT RECIPIENTS identification number FATCA fing requirement (keep for your records) CORRECTED (if checked) Payer's RTN (optional) 1 Interest income 2 Early withdrawal penalty 4 Federal income tax withheld 6 Foreign tax paid $56.98 8 Tax-exempt interest 3 Interest on U.S. Savings Bonds and Treas, obligations 10 Market discourt 12 Bond premium on Treasury obligations OMB No. 1545-0112 14 Tax-exempt and tax credit bond CUSIP no www.irs.gov/form 1099int 2016 Form 1099-INT 5 investment expenses 7 Foreign country or U.S. possession 19 Specified private activity bond interest 11 Bond premium 15 State NM 13 Bond premium on tax-exempt bond Interest Income Copy B For Recipient This is important tax Information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. 16 State identification no. 03-221595-00-9 Department of the Treasury - Intemal Revenue Service 17 State tax withheld

Step by Step Solution

3.48 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started