Question

John and Jane Doe are married. They have no children. John and Jane are both employed at ACME Corporation. To supplement their regular salaries, the

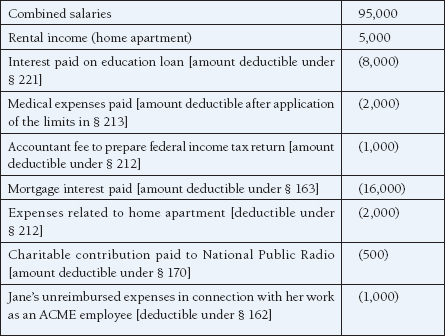

John and Jane Doe are married. They have no children. John and Jane are both employed at ACME Corporation. To supplement their regular salaries, the Does converted the basement of their home into a one-bedroom apartment that they rent to a struggling student at Law School. For 2018, the Does had the following items of income and expense (expense items are marked in parentheses):

(a) Determine the Does taxable income for 2018, assuming they file a joint return. Assume that the rental activity is not a trade or business but instead an investment activity (one entered into for profit but which does not rise to the level of a trade or business.

(b) Same as (a), but assume that all of these events occurred in 2017. Determine the couples taxable income for 2017.

95,000 5,000 (8,000) (2,000) (1,000) Combined salaries Rental income (home apartment) Interest paid on education loan [amount deductible under $ 221] Medical expenses paid [amount deductible after application of the limits in $ 213] Accountant fee to prepare federal income tax return [amount deductible under $ 212] Mortgage interest paid [amount deductible under $ 163) Expenses related to home apartment (deductible under $ 212] Charitable contribution paid to National Public Radio [amount deductible under $ 170] Jane's unreimbursed expenses in connection with her work as an ACME employee (deductible under $ 162] (16,000) (2,000) (500) (1,000) 95,000 5,000 (8,000) (2,000) (1,000) Combined salaries Rental income (home apartment) Interest paid on education loan [amount deductible under $ 221] Medical expenses paid [amount deductible after application of the limits in $ 213] Accountant fee to prepare federal income tax return [amount deductible under $ 212] Mortgage interest paid [amount deductible under $ 163) Expenses related to home apartment (deductible under $ 212] Charitable contribution paid to National Public Radio [amount deductible under $ 170] Jane's unreimbursed expenses in connection with her work as an ACME employee (deductible under $ 162] (16,000) (2,000) (500) (1,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started