Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John and Kelly own 260 and 240 shares, respectively, of Stand Up Corporation stock, which represent all the shares outstanding. The current market value

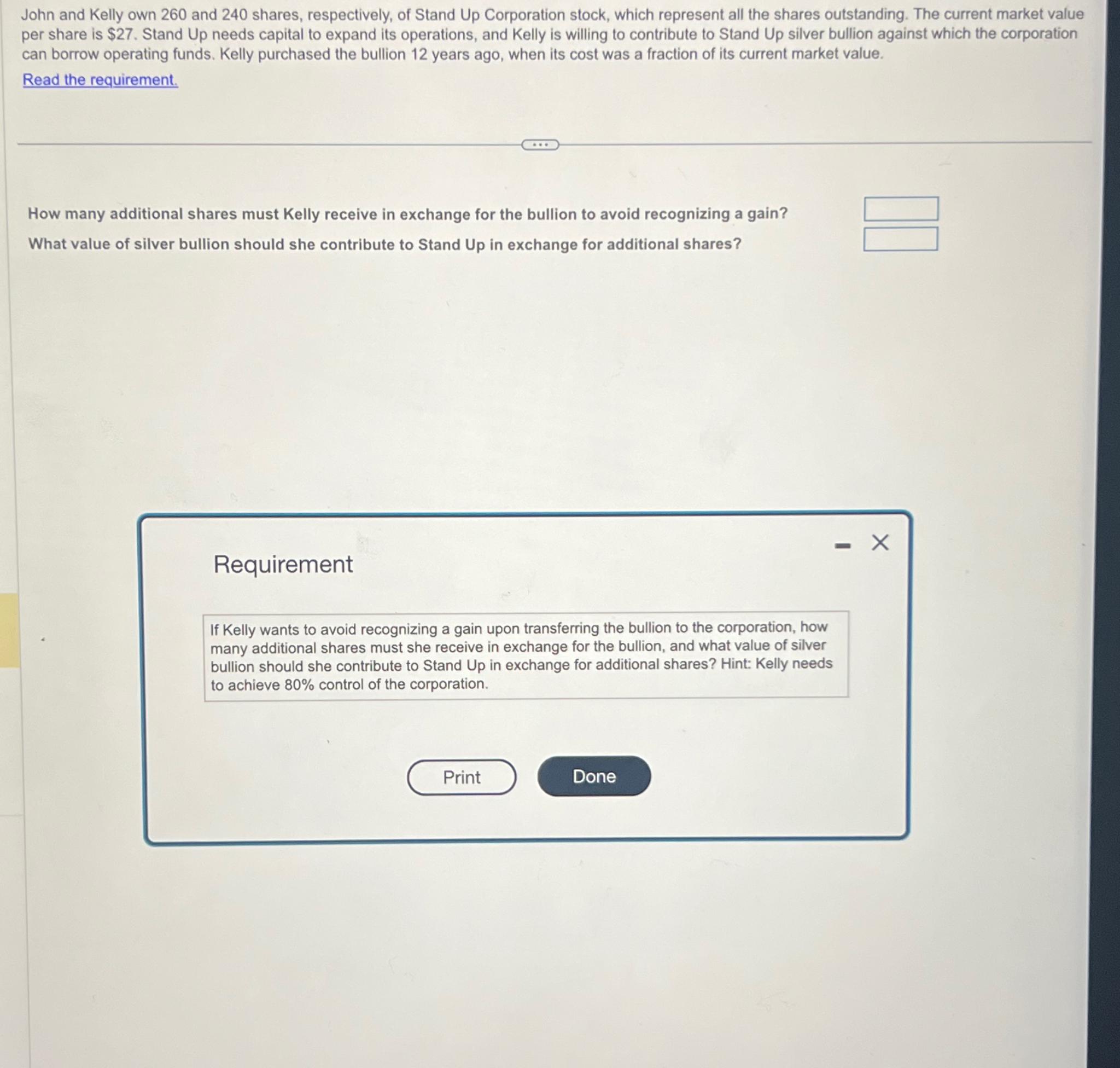

John and Kelly own 260 and 240 shares, respectively, of Stand Up Corporation stock, which represent all the shares outstanding. The current market value per share is $27. Stand Up needs capital to expand its operations, and Kelly is willing to contribute to Stand Up silver bullion against which the corporation can borrow operating funds. Kelly purchased the bullion 12 years ago, when its cost was a fraction of its current market value. Read the requirement. How many additional shares must Kelly receive in exchange for the bullion to avoid recognizing a gain? What value of silver bullion should she contribute to Stand Up in exchange for additional shares? Requirement If Kelly wants to avoid recognizing a gain upon transferring the bullion to the corporation, how many additional shares must she receive in exchange for the bullion, and what value of silver bullion should she contribute to Stand Up in exchange for additional shares? Hint: Kelly needs to achieve 80% control of the corporation. Print Done -

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To avoid recognizing a gain upon transferring the bullion to the corporation Kelly needs to achieve ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started