Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Christiania Investments has a project to develop next year, for which they will require 4.200.000,00 They are planning to obtain this required capital using

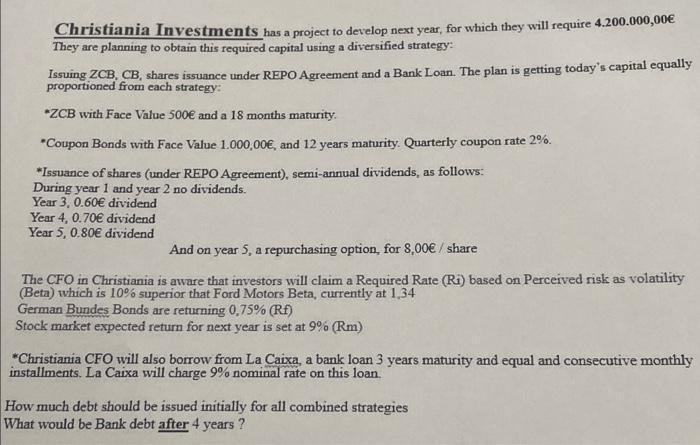

Christiania Investments has a project to develop next year, for which they will require 4.200.000,00 They are planning to obtain this required capital using a diversified strategy: Issuing ZCB, CB, shares issuance under REPO Agreement and a Bank Loan. The plan is getting today's capital equally proportioned from each strategy: *ZCB with Face Value 500 and a 18 months maturity. *Coupon Bonds with Face Value 1.000,00, and 12 years maturity. Quarterly coupon rate 2%. *Issuance of shares (under REPO Agreement), semi-annual dividends, as follows: During year 1 and year 2 no dividends. Year 3, 0.60 dividend Year 4, 0.70 dividend Year 5, 0.80 dividend And on year 5, a repurchasing option, for 8,00 / share The CFO in Christiania is aware that investors will claim a Required Rate (Ri) based on Perceived risk as volatility (Beta) which is 10% superior that Ford Motors Beta, currently at 1,34 German Bundes Bonds are returning 0,75% (Rf) Stock market expected return for next year is set at 9% (Rm) *Christiania CFO will also borrow from La Caixa, a bank loan 3 years maturity and equal and consecutive monthly installments. La Caixa will charge 9% nominal rate on this loan. How much debt should be issued initially for all combined strategies What would be Bank debt after 4 years?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The initial debt to be issued for all combined strategies should be 420000000 This amount will be divided into different financial instrument...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started