John Berman, CPA, is the quality review manager for several engagements. Below is a list of situations that were presented to John. For each

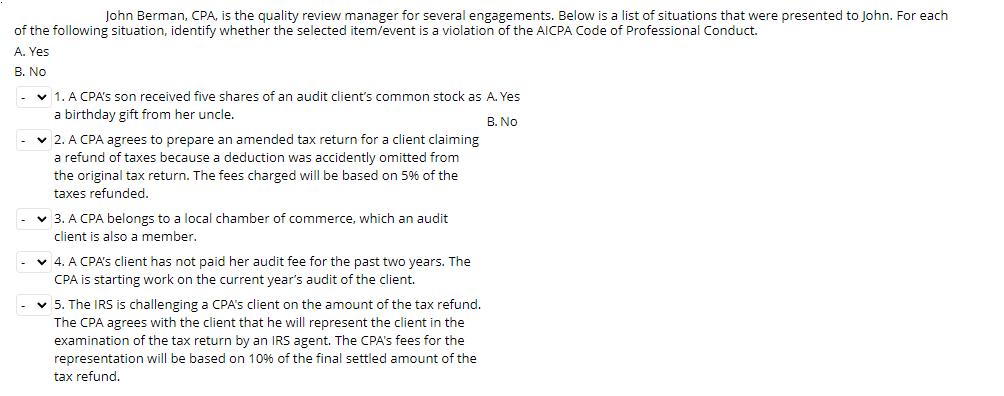

John Berman, CPA, is the quality review manager for several engagements. Below is a list of situations that were presented to John. For each of the following situation, identify whether the selected item/event is a violation of the AICPA Code of Professional Conduct. A. Yes B. No v 1. A CPA's son received five shares of an audit client's common stock as A. Yes a birthday gift from her uncle. B. No v 2. A CPA agrees to prepare an amended tax return for a client claiming a refund of taxes because a deduction was accidently omitted from the original tax return. The fees charged will be based on 59%6 of the taxes refunded. v 3. A CPA belongs to a local chamber of commerce, which an audit client is also a member. v 4. A CPA'S client has not paid her audit fee for the past two years. The CPA is starting work on the current year's audit of the client. v 5. The IRS is challenging a CPA's client on the amount of the tax refund. The CPA agrees with the client that he will represent the client in the examination of the tax return by an IRS agent. The CPA's fees for the representation will be based on 10% of the final settled amount of the tax refund.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answers CPAS son received five shares of an audit client common stock as a birthday gift from her uncle Yes During his performance of his professional ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started