Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Brown is a self-employed architect. He purchased a house in the outer suburbs of Melbourne in July 2016. He purchased the property because

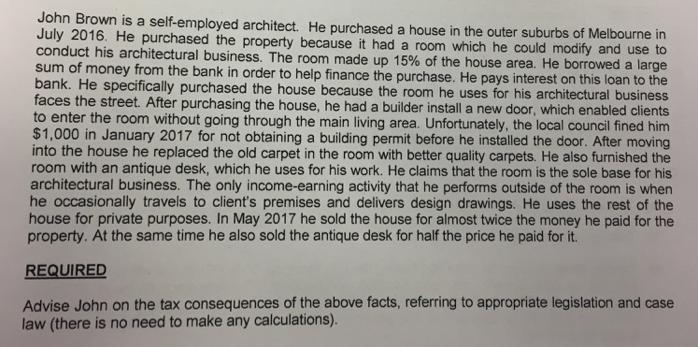

John Brown is a self-employed architect. He purchased a house in the outer suburbs of Melbourne in July 2016. He purchased the property because it had a room which he could modify and use to conduct his architectural business. The room made up 15% of the house area. He borrowed a large sum of money from the bank in order to help finance the purchase. He pays interest on this loan to the bank. He specifically purchased the house because the room he uses for his architectural business faces the street. After purchasing the house, he had a builder install a new door, which enabled clients to enter the room without going through the main living area. Unfortunately, the local council fined him $1,000 in January 2017 for not obtaining a building permit before he installed the door. After moving into the house he replaced the old carpet in the room with better quality carpets. He also furnished the room with an antique desk, which he uses for his work. He claims that the room is the sole base for his architectural business. The only income-earning activity that he performs outside of the room is when he occasionally travels to client's premises and delivers design drawings. He uses the rest of the house for private purposes. In May 2017 he sold the house for almost twice the money he paid for the property. At the same time he also sold the antique desk for half the price he paid for it. REQUIRED Advise John on the tax consequences of the above facts, referring to appropriate legislation and case law (there is no need to make any calculations).

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 purchase of house not deductibles 81 capital outgoing negative limb of s 81 creation of asset 2 Us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started