Answered step by step

Verified Expert Solution

Question

1 Approved Answer

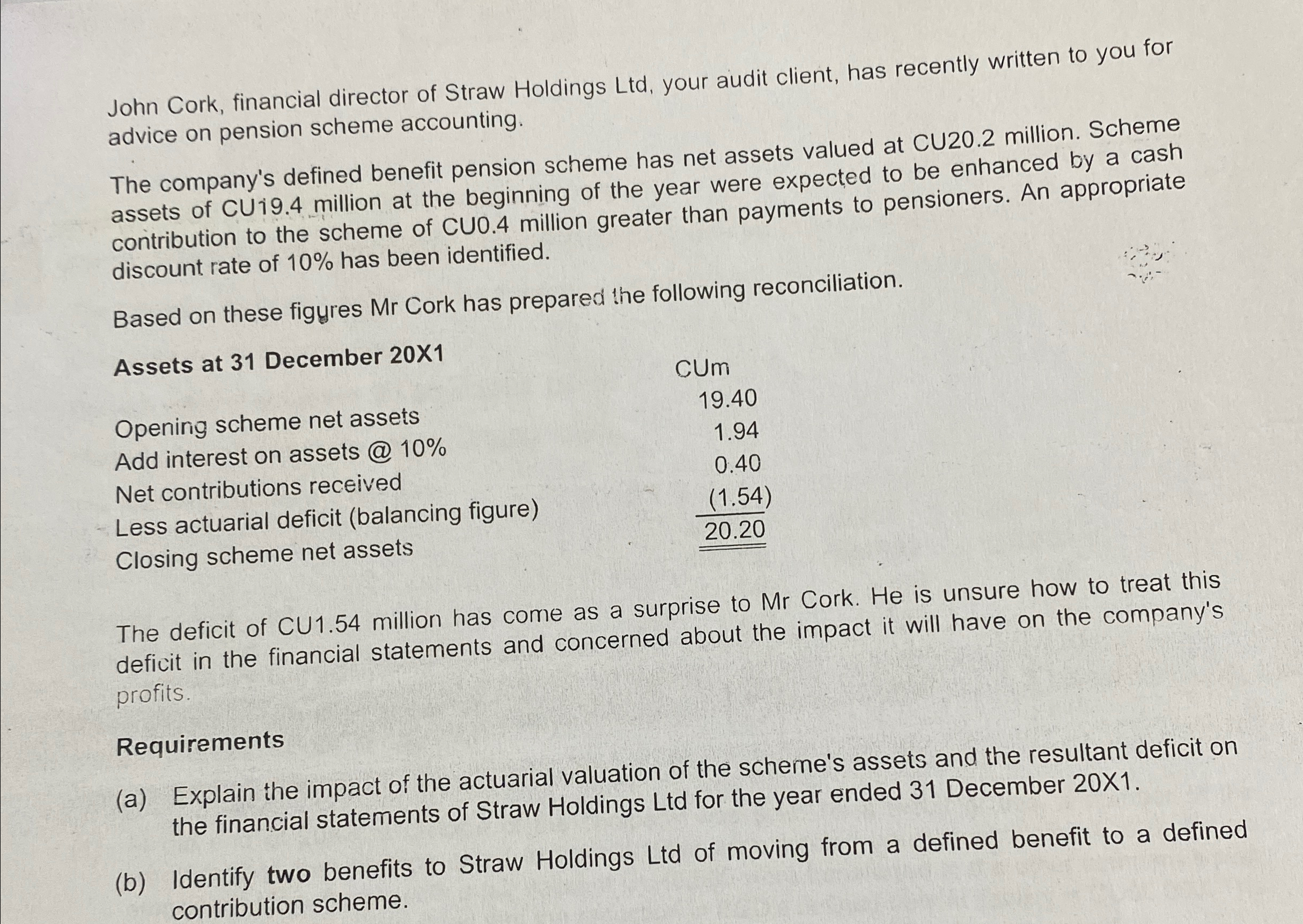

John Cork, financial director of Straw Holdings Ltd , your audit client, has recently written to you for advice on pension scheme accounting. The company's

John Cork, financial director of Straw Holdings Ltd your audit client, has recently written to you for

advice on pension scheme accounting.

The company's defined benefit pension scheme has net assets valued at CU million. Scheme

assets of CUi million at the beginning of the year were expected to be enhanced by a cash

contribution to the scheme of CUO. million greater than payments to pensioners. An appropriate

discount rate of has been identified.

Based on these figyres Mr Cork has prepared the following reconciliation.

The deficit of CU million has come as a surprise to Mr Cork. He is unsure how to treat this

deficit in the financial statements and concerned about the impact it will have on the company's

profits.

Requirements

a Explain the impact of the actuarial valuation of the scheme's assets and the resultant deficit on

the financial statements of Straw Holdings Ltd for the year ended December X

b Identify two benefits to Straw Holdings Ltd of moving from a defined benefit to a defined

contribution scheme.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started