Q2: XYZ company had $7 million in (EBIT). Its depreciation expense was $2 million, its interest expense was $2 million, and its corporate tax

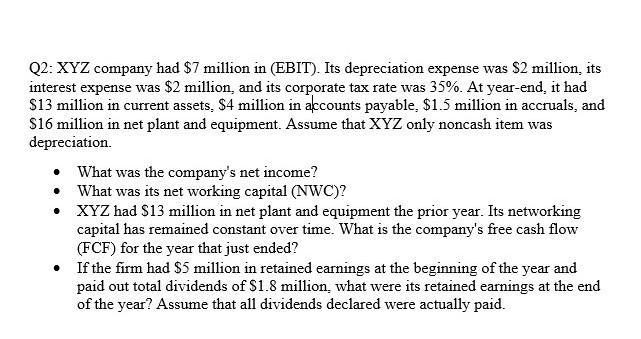

Q2: XYZ company had $7 million in (EBIT). Its depreciation expense was $2 million, its interest expense was $2 million, and its corporate tax rate was 35%. At year-end, it had $13 million in current assets, $4 million in accounts payable, $1.5 million in accruals, and $16 million in net plant and equipment. Assume that XYZ only noncash item was depreciation. . What was the company's net income? What was its net working capital (NWC)? XYZ had $13 million in net plant and equipment the prior year. Its networking capital has remained constant over time. What is the company's free cash flow (FCF) for the year that just ended? If the firm had $5 million in retained earnings at the beginning of the year and paid out total dividends of $1.8 million, what were its retained earnings at the end of the year? Assume that all dividends declared were actually paid.

Step by Step Solution

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a Net Income EBIT Interest Expense 1 Tax Rate Net Income 700 million 200 million 1 035 Net Income 50...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started