Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John died on March 3, 2019. His gross estate of $16.5 million includes First Corporation stock (400 of the 1,000 outstanding shares) worth $10

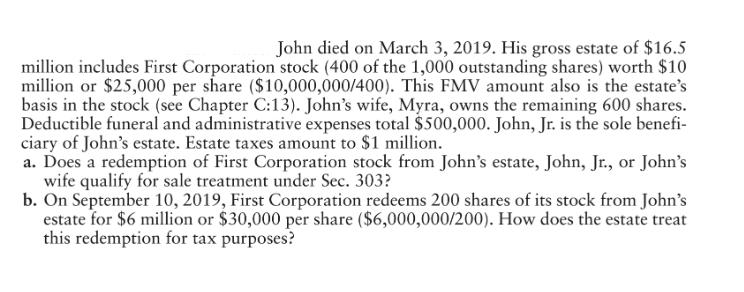

John died on March 3, 2019. His gross estate of $16.5 million includes First Corporation stock (400 of the 1,000 outstanding shares) worth $10 million or $25,000 per share ($10,000,000/400). This FMV amount also is the estate's basis in the stock (see Chapter C:13). John's wife, Myra, owns the remaining 600 shares. Deductible funeral and administrative expenses total $500,000. John, Jr. is the sole benefi- ciary of John's estate. Estate taxes amount to $1 million. a. Does a redemption of First Corporation stock from John's estate, John, Jr., or John's wife qualify for sale treatment under Sec. 303? b. On September 10, 2019, First Corporation redeems 200 shares of its stock from John's estate for $6 million or $30,000 per share ($6,000,000/200). How does the estate treat this redemption for tax purposes?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Provisions of Section 303 As per section 303 on the death of a stockholder the redemption of his hol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started