Question

John has just turned 20 and his rich relatives are thinking of giving him an investment while he is young, which will pay for his

John has just turned 20 and his rich relatives are thinking of giving him an investment while he is young, which will pay for his retirement. They hope that by investing early, the investment they make for him will grow sufficiently to guarantee him a comfortable retirement. They therefore approach a financial advisor to help them make the calculations. The plan is for John to retire on his 70th birthday (i.e., in 50 years time). His life expectancy is 85 years. During his retirement (i.e., until his 85th birthday), they plan for John to receive 30,000 per year, starting on his 71st birthday. The interest rate that applies to his retirement period is 5% per year.

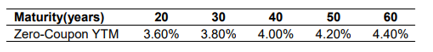

Not sure if this table is required for later parts of the question i.e. part c and d.

c) Johns relatives become concerned that his retirement pension might not be enough to live on over time due to inflation. They therefore instruct the financial advisor to present an alternative plan, in which John retires at 70, and receives a yearly pension which would give him 30,000 on his 71st birthday, and afterwards would give him annual payments which grew at a rate of 2% every year, finishing on his 85th birthday. The interest rate that applies to his retirement period is 5% per year. They still plan to fund this by investing in a suitable zero-coupon bond, which would be bought when John is 20, and which would mature when he is 70. How much would need to be invested in a suitable zero-coupon bond when John is 20, to pay for this alternative retirement plan?

d) John likes the scheme in part c). However, he would rather retire earlier, when he is 60, so that he receives 30,000 on his 61st birthday, and afterwards receives annual payments which grow at a rate of 2% every year and finish on his 85th birthday. As before, this annuity would be financed by a suitable zerocoupon bond, bought when John is 20 and maturing when he is 60. The interest rate that applies to his retirement period is 5% per year. How much would need to be invested in a suitable zero-coupon bond when John is 20, to finance this plan?

Disclosure: This is NOT homework that I intend to submit.

Maturity(years) Zero-Coupon YTM 20 3.60% 30 3.80% 40 4.00% 50 4.20% 60 4.40%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started