Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John has just turned 20 and his rich relatives are thinking of giving him an investment while he is young, which will pay for his

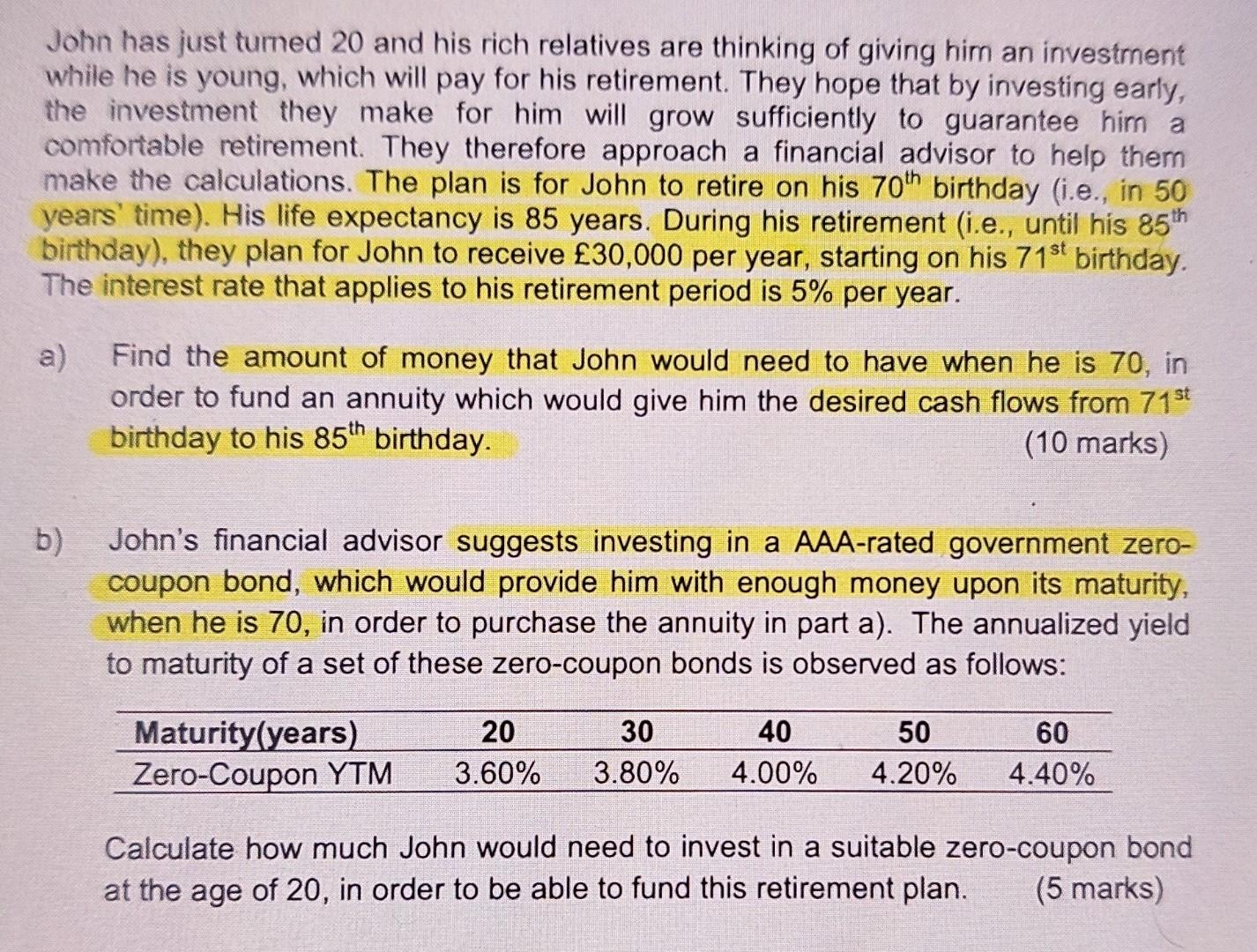

John has just turned 20 and his rich relatives are thinking of giving him an investment while he is young, which will pay for his retirement. They hope that by investing early, the investment they make for him will grow sufficiently to guarantee him a comfortable retirement. They therefore approach a financial advisor to help thern make the calculations. The plan is for John to retire on his 70th birthday (i.e., in 50 years' time). His life expectancy is 85 years. During his retirement (i.e., until his 85th birthday), they plan for John to receive 30,000 per year, starting on his 71st birthday. The interest rate that applies to his retirement period is 5% per year. a) Find the amount of money that John would need to have when he is 70, in order to fund an annuity which would give him the desired cash flows from 71st birthday to his 85th birthday. (10 marks) b) John's financial advisor suggests investing in a AAA-rated government zero- coupon bond, which would provide him with enough money upon its maturity, when he is 70, in order to purchase the annuity in part a). The annualized yield to maturity of a set of these zero-coupon bonds is observed as follows: 30 Maturity(years) Zero-Coupon YTM 20 3.60% 40 4.00% 50 4.20% 60 4.40% 3.80% Calculate how much John would need to invest in a suitable zero-coupon bond at the age of 20, in order to be able to fund this retirement plan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started