Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John is a partner in an audit firm. Last year, another partner, Ellen, retired and joined GGG Inc. as a director. GGG develops video

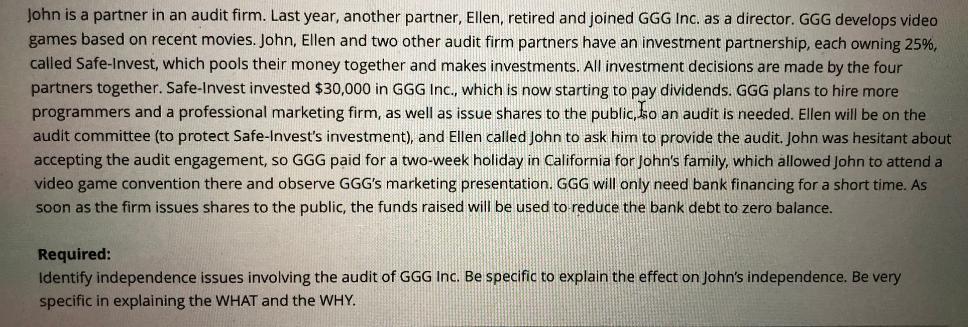

John is a partner in an audit firm. Last year, another partner, Ellen, retired and joined GGG Inc. as a director. GGG develops video games based on recent movies. John, Ellen and two other audit firm partners have an investment partnership, each owning 25%, called Safe-Invest, which pools their money together and makes investments. All investment decisions are made by the four partners together. Safe-Invest invested $30,000 in GGG Inc., which is now starting to pay dividends. GGG plans to hire more programmers and a professional marketing firm, as well as issue shares to the public, so an audit is needed. Ellen will be on the audit committee (to protect Safe-Invest's investment), and Ellen called John to ask him to provide the audit. John was hesitant about accepting the audit engagement, so GGG paid for a two-week holiday in California for John's family, which allowed John to attend a video game convention there and observe GGG's marketing presentation. GGG will only need bank financing for a short time. As soon as the firm issues shares to the public, the funds raised will be used to reduce the bank debt to zero balance. Required: Identify independence issues involving the audit of GGG Inc. Be specific to explain the effect on John's independence. Be very specific in explaining the WHAT and the WHY.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

There are several independence issues involving the audit of GGG Inc that affect Johns independence as a partner in the audit firm These issues can be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started