Answered step by step

Verified Expert Solution

Question

1 Approved Answer

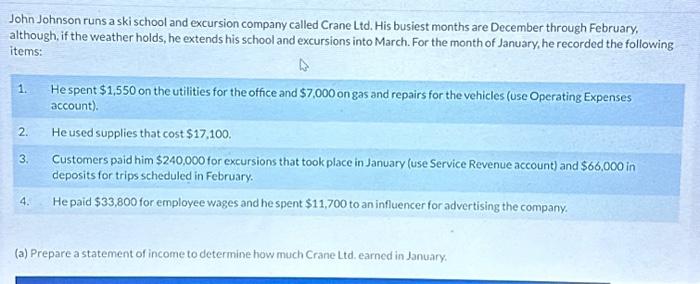

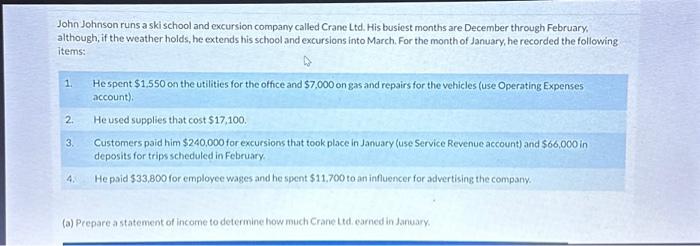

John Johnson runs a ski school and excursion company called Crane Ltd. His busiest months are December through February, although, if the weather holds, he

John Johnson runs a ski school and excursion company called Crane Ltd. His busiest months are December through February, although, if the weather holds, he extends his school and excursions into March. For the month of January, he recorded the following items: 1. 2. 3. 4. He spent $1,550 on the utilities for the office and $7,000 on gas and repairs for the vehicles (use Operating Expenses account). He used supplies that cost $17,100. Customers paid him $240,000 for excursions that took place in January (use Service Revenue account) and $66,000 in deposits for trips scheduled in February. He paid $33,800 for employee wages and he spent $11,700 to an influencer for advertising the company. (a) Prepare a statement of income to determine how much Crane Ltd. earned in January,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started