Question

John Johnson, the CFO of Crane Automotive, Inc., is putting together this year's financial statements. He has gathered the following balance sheet information: The firm

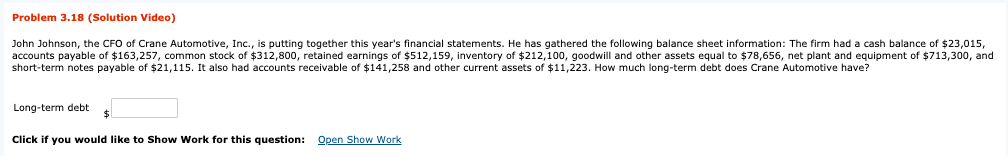

John Johnson, the CFO of Crane Automotive, Inc., is putting together this year's financial statements. He has gathered the following balance sheet information: The firm had a cash balance of $23,015, accounts payable of $163,257, common stock of $312,800, retained earnings of $512,159, inventory of $212,100, goodwill and other assets equal to $78,656, net plant and equipment of $713,300, and short-term notes payable of $21,115. It also had accounts receivable of $141,258 and other current assets of $11,223. How much long-term debt does Crane Automotive have?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started