Question

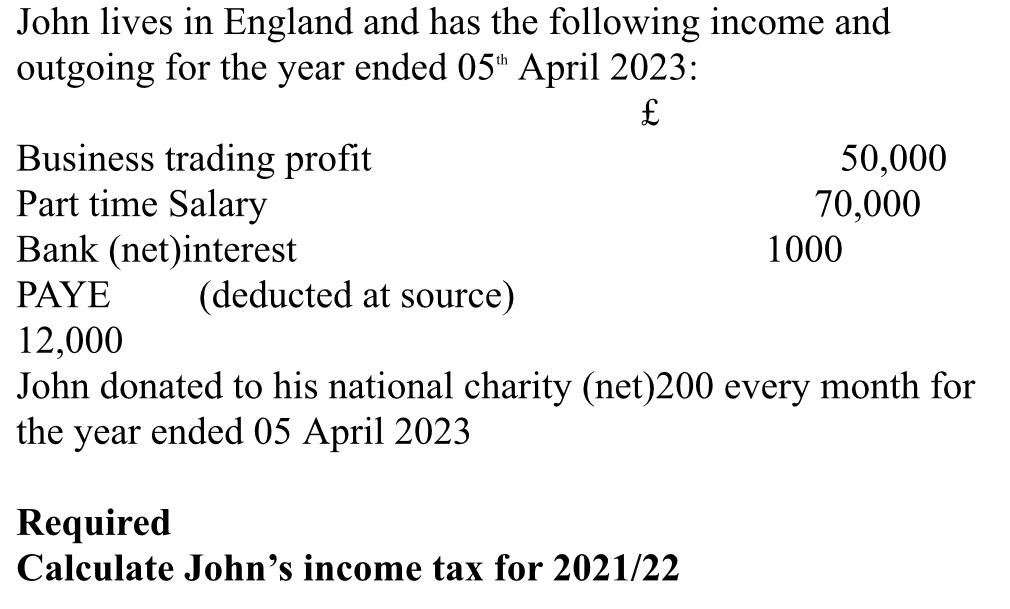

John lives in England and has the following income and outgoing for the year ended 05th April 2023: Business trading profit Part time Salary

John lives in England and has the following income and outgoing for the year ended 05th April 2023: Business trading profit Part time Salary Bank (net)interest PAYE (deducted at source) 12,000 John donated to his national charity (net) 200 every month for the year ended 05 April 2023 Required Calculate John's income tax for 2021/22 50,000 70,000 1000

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Johns income tax for the 20212022 tax year we would follow these steps 1 Sum up all income sources to get total income 2 Deduct any allowable expenses or allowances like personal allowanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance services an integrated approach

Authors: Alvin a. arens, Randal j. elder, Mark s. Beasley

14th Edition

133081605, 132575957, 9780133081602, 978-0132575959

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App