Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John McCurdy has recently joined a consultant group that provides investment advice to the managers of a special investment fund. This investment fund was created

John McCurdy has recently joined a consultant group that provides investment advice to the managers of a special investment fund. This investment fund was created by a group of NFPOs, all of which have endowment funds, and rather than investing their resources individually, they have instead chosen a pooled approach whereby a single fund invests their moneys and distributes the earnings back to them on an annual basis. The Board of Directors of the investment fund, made up of members from each of the NFPOs, meets periodically to review performance and to make investment decisions.

John has been following the fortunes of Ajax Communications Corporation for a number of years. Ajax is a Canadian company listed on the TSX. At the beginning of this past year, Ajax acquired 60% of the shares of Waqaas Inc., a U.S. company, which was and continues to be listed on the NYSE. Ajax must decide whether to prepare Financial Statements for Waqaas in accordance with IFRS or U.S. GAAP for reporting to the SEC.

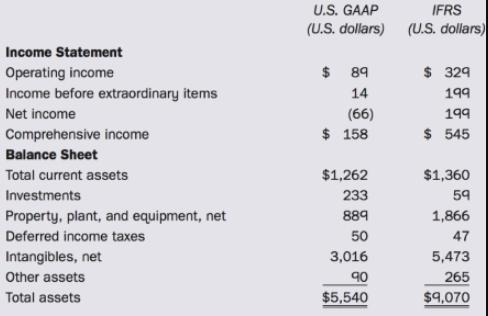

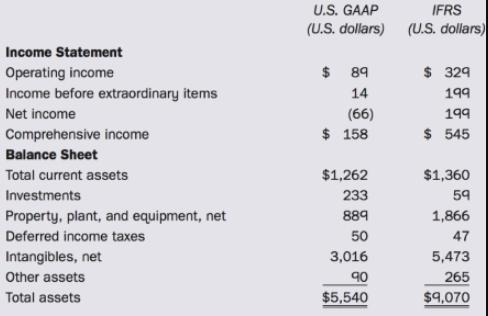

As a starting point, John asked for and received the following comparison of financial statement information under U.S. GAAP and IFRS from the controller at Waqaas (in millions of dollars):

Working with this list, John's next step will be to determine why there is such a difference in the numbers.

Working with this list, John's next step will be to determine why there is such a difference in the numbers.

Required:

(a) As John McCurdy, outline the initial approach that you will take in order to determine the reasons for the differences in the numbers.

(b) List some of the obvious items that need resolution, and indicate some of the possible causes of the discrepancies.

(c) In your opinion, which GAAP best reflects economic reality? Briefly explain.

John has been following the fortunes of Ajax Communications Corporation for a number of years. Ajax is a Canadian company listed on the TSX. At the beginning of this past year, Ajax acquired 60% of the shares of Waqaas Inc., a U.S. company, which was and continues to be listed on the NYSE. Ajax must decide whether to prepare Financial Statements for Waqaas in accordance with IFRS or U.S. GAAP for reporting to the SEC.

As a starting point, John asked for and received the following comparison of financial statement information under U.S. GAAP and IFRS from the controller at Waqaas (in millions of dollars):

Working with this list, John's next step will be to determine why there is such a difference in the numbers.

Working with this list, John's next step will be to determine why there is such a difference in the numbers.Required:

(a) As John McCurdy, outline the initial approach that you will take in order to determine the reasons for the differences in the numbers.

(b) List some of the obvious items that need resolution, and indicate some of the possible causes of the discrepancies.

(c) In your opinion, which GAAP best reflects economic reality? Briefly explain.

Income Statement Operating income Income before extraordinary items Net income Comprehensive income Balance Sheet Total current assets Investments Property, plant, and equipment, net Deferred income taxes Intangibles, net Other assets Total assets U.S. GAAP (U.S. dollars) $ 89 14 (66) $ 158 $1,262 233 889 50 3,016 90 $5,540 IFRS (U.S. dollars) $ 329 199 199 $ 545 $1,360 59 1,866 47 5,473 265 $9,070

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a As John McCurdy I would start by reviewing the accounting policies of bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started