Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John observed the prices of three government bonds trading on Bond Exchange of South Africa. The first bond was trading at a price of

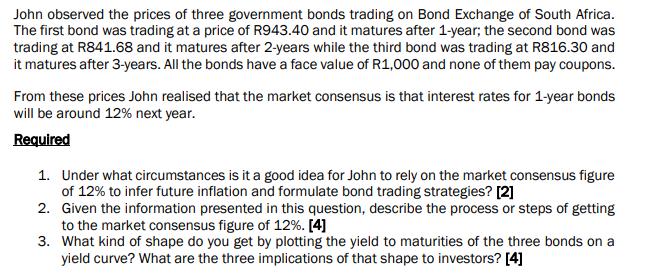

John observed the prices of three government bonds trading on Bond Exchange of South Africa. The first bond was trading at a price of R943.40 and it matures after 1-year; the second bond was trading at R841.68 and it matures after 2-years while the third bond was trading at R816.30 and it matures after 3-years. All the bonds have a face value of R1,000 and none of them pay coupons. From these prices John realised that the market consensus is that interest rates for 1-year bonds will be around 12% next year. Required 1. Under what circumstances is it a good idea for John to rely on the market consensus figure of 12% to infer future inflation and formulate bond trading strategies? [2] 2. Given the information presented in this question, describe the process or steps of getting to the market consensus figure of 12%. [4] 3. What kind of shape do you get by plotting the yield to maturities of the three bonds on a yield curve? What are the three implications of that shape to investors? [4]

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

1 John should not rely on the market consensus figure of 12 to infer future inflation and formulate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started