Question

John Payne and Richard Rogers are filing the tax return for GAS MONKEE. They have asked you to prepare the tax return for the corporation

John Payne and Richard Rogers are filing the tax return for GAS MONKEE. They have asked you to prepare the tax return for the corporation based on the following information. The address of GAS MONKEE is as follows: 1 Gas Monkee Ave., Dallas, TX 07810. Their EIN is 00-0000001. They do not know their principal business activity code.

Ownership percentage is based on the fact scenario in the Memo. John is President and Richard is vice-president. There is only one authorized class of common stock.

Both John and Richard are employees as well. John's social security number is 111-11-1111 and Richard's is 111-11-1112.

GAS MONKEE is an accrual method, calendar year taxpayer. Inventories are determined under the FIFO or lower of cost or market method. Gas Monkee uses the straight-line method of depreciation for book and accelerated depreciation for tax purposes.

During 2018, the corporation distributed cash dividends of $20,000.00

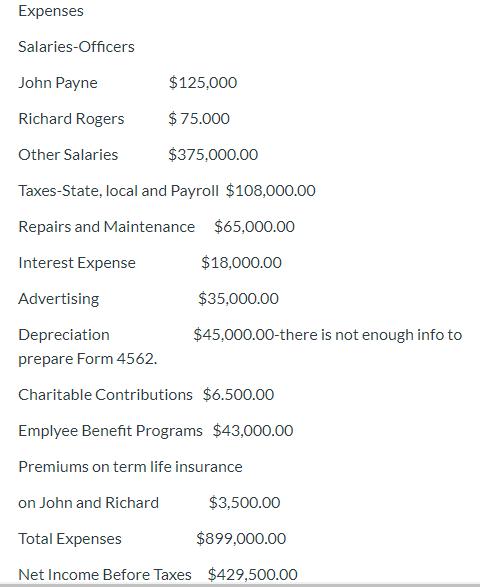

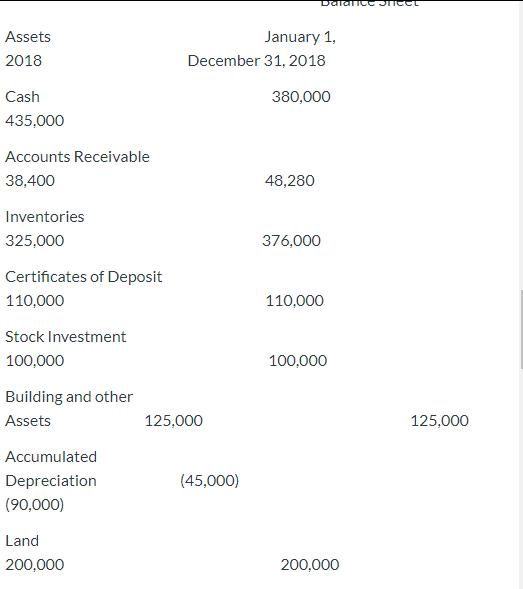

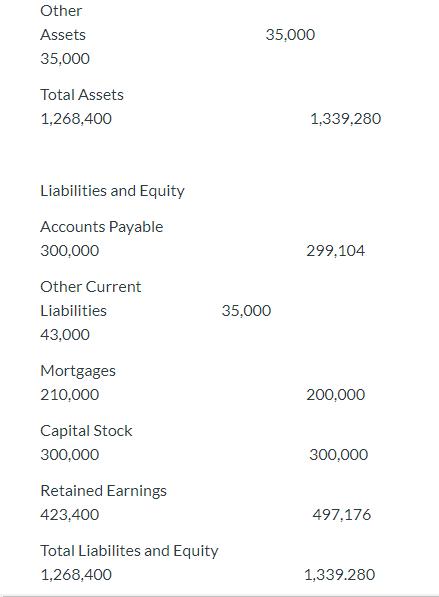

Gas Monkee's Financials are listed below;

During 2018, Gas Monkee made estimated payments of $10,500.00 for the entire year. Prepare a form 1120 for Gas Monkee for 2018.

Income Statement Income-Sales and Services 3,250,000.00 Sales Returns and Allowances 250,000.00 Net Sales Cost of Goods Sold Gross Profit Dividends received from stock investments in less than 20% owned US Corporations 23,500 Interest Income State Bonds CD's Total Income 3,000,000.00 1,730.000.00 1,270,000.00 15,000 20,000 $1,328,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started