Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John secured employment as a commissioned salesman in July, 2021. In 2021, he received a base salary of $60,000, and $10,000 of commissions. John

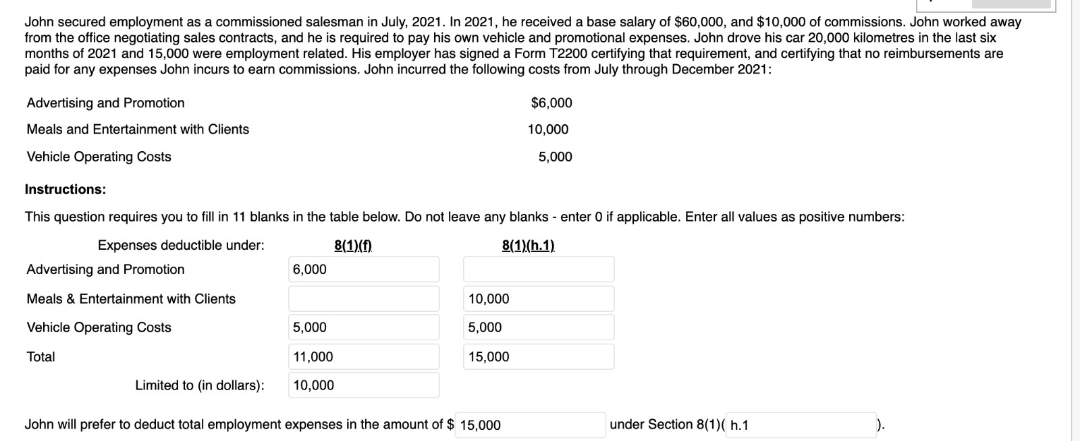

John secured employment as a commissioned salesman in July, 2021. In 2021, he received a base salary of $60,000, and $10,000 of commissions. John worked away from the office negotiating sales contracts, and he is required to pay his own vehicle and promotional expenses. John drove his car 20,000 kilometres in the last six months of 2021 and 15,000 were employment related. His employer has signed a Form T2200 certifying that requirement, and certifying that no reimbursements are paid for any expenses John incurs to earn commissions. John incurred the following costs from July through December 2021: Advertising and Promotion Meals and Entertainment with Clients $6,000 10,000 5,000 Vehicle Operating Costs Instructions: This question requires you to fill in 11 blanks in the table below. Do not leave any blanks - enter 0 if applicable. Enter all values as positive numbers: Expenses deductible under: 8(1)(f) 6,000 8(1)(h.1) Advertising and Promotion Meals & Entertainment with Clients 10,000 Vehicle Operating Costs 5,000 5,000 Total 11,000 15,000 Limited to (in dollars): 10,000 John will prefer to deduct total employment expenses in the amount of $ 15,000 under Section 8(1)( h.1 ).

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Expenses deductible under 81f 81h1 Advertising and Promoti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started